Carnival Corp (NYSE:CCL) delivered a better-than-anticipated performance for the first quarter, with revenue increasing by 22.1% year-over-year to $5.41 billion. Additionally, its net loss per share of $0.14 came in narrower than estimates by $0.04. However, shares of the leisure travel services company are under pressure today despite buoyant customer demand for its offerings.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Buoyant Demand

The quarter was marked by strong demand trends and increased ticket pricing for CCL, with total customer deposits reaching a record $7 billion during this period. During the quarter, cruise costs per available lower berth day (ALBD) increased by 7.9% year-over-year. However, CCL’s adjusted EBITDA of $871 million came in nearly $70 million higher than its prior expectations.

Robust Outlook

For Fiscal year 2024, CCL expects adjusted EBITDA to rise by over 30% to $5.63 billion compared to 2023. For the upcoming quarter, the company anticipates adjusted EBITDA to balloon by over 50% year-over-year to $1.05 billion.

Is CCL a Good Stock to Buy Now?

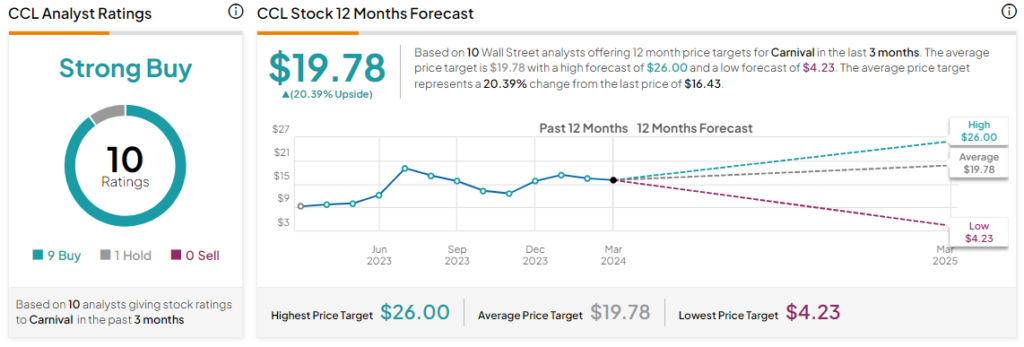

CCL’s share price has rallied by nearly 20% over the past six months. Overall, consensus on the Street remains a Strong Buy for Carnival alongside an average CCL price target of $19.78. This points to a further upside potential of 20.4% in the company’s share price. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure