Mediterranean fast-casual restaurant chain operator Cava (NYSE:CAVA) will announce its Q1 2024 results on Tuesday, May 28. The company’s value proposition and focus on growing its geographical footprint will likely support its sales and earnings in Q1. However, macro-uncertainty could pose challenges.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But before we dig deeper, it’s worth noting that CAVA stock has gained nearly 93% year-to-date, reflecting the company’s solid sales growth led by higher traffic.

CAVA – Q1 Expectations

Wall Street analysts expect CAVA to report total revenue of $246.02 million, up about 21% year over year. Cava’s top line is likely to benefit from higher same-restaurant sales, led by higher traffic and an increase in pricing. Further, new restaurant openings will support its overall sales.

Analysts expect Cava to report earnings of $0.04 per share in Q1 compared to a loss per share of $0.02 in the prior-year quarter.

Analysts Predict Strong Q1 Performance

Stifel Nicolaus analyst Chris O’Cull raised the price target on CAVA stock to $90 from $66 ahead of the Q1 print. The analyst reiterated a Buy recommendation on CAVA stock on May 24 and expects the company to deliver a solid Q1, led by same-restaurant sales growth.

Echoing similar sentiments, Baird analyst David Tarantino, an analyst ranked among the top 1% of Street stock experts (to watch Tarantino’s track record, click here), increased his price target on CAVA stock to $90 from $72. The analyst expects the company to report solid financials throughout 2024. Tarantino maintained a Buy on CAVA stock.

On the other hand, Citi analyst Jon Tower reiterated a Hold on CAVA stock on May 20, citing the company’s high valuation. Nonetheless, Tower increased the price target to $81 from $60 and expects the company to beat estimates.

Options Traders Anticipate a Large Move

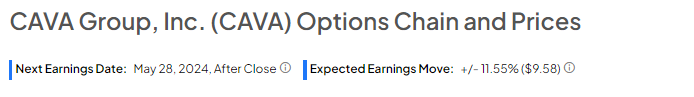

Using TipRanks’ Options tool, we can observe traders’ expectations for the stock’s movement following its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. While this may seem complex, the Options tool simplifies the process. This indicates that options traders expect a significant 11.55% movement in either direction.

Is CAVA Stock a Good Buy?

Wall Street is cautiously optimistic about CAVA stock ahead of Q1 earnings. It has eight Buys and three holds for a Moderate Buy consensus rating. The analysts’ average price target for CAVA stock is $71.09, implying a 14.28% downside potential from current levels.