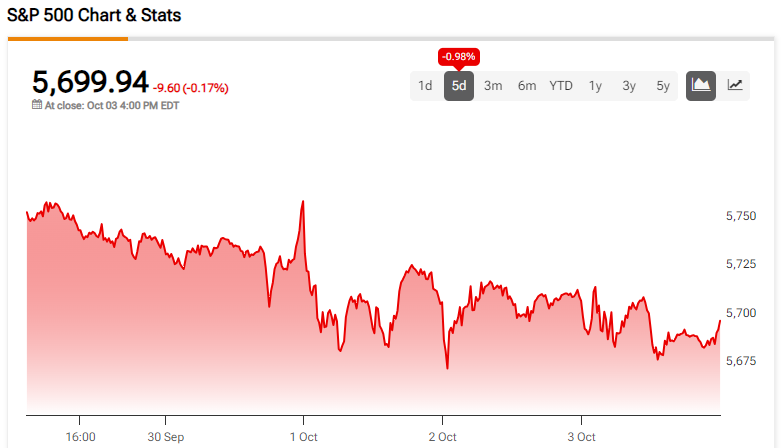

Thursday brought another cautious trading day, and with low volume. October 3 was the 10th consecutive market day with the S&P 500 index (SPX) moving less than 1%. The most recent session with a +/- 1% move or greater was September 19th, the day after the Federal Open Market Committee (FOMC) slashed short-term borrowing rates by 50 bps.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors continue to monitor developments in the middle-east, and will be looking for Friday October 4th’s non-farm payrolls report to give the market direction.

September Payroll Expectations

Economists are looking for a slight acceleration in September job numbers, anticipating a print of 148k as compared to 142k last month. Achieving a non-farm payrolls number higher than the one from August could go a long way towards reinforcing the belief that the economy is on stable footing, and not headed for a hard landing. Some market observers have suggested that recession predictions have very little runway left, and that a few more positive economic indicators will substantially ease concerns about any sharp slowdown.

Accompanying Friday’s non-farm payrolls number, economists are expecting the unemployment rate to remain at 4.2% in the United States. Meanwhile, average hourly earnings are expected to drop from a year-over-year growth rate of 3.8% to 3.3%. That would be consistent with other recent readings of slowing inflation.

Investors can follow the Friday 8:30am (EST) data releases on the TipRanks economics page.

Middle-East Tensions

Crude Oil Futures (CL) jumped more than $3 per barrel on Thursday, as the world awaits to see what, if anything, will follow Iran’s large ballistic missile launch earlier this week. Some economic analysts have been concerned that oil prices weren’t spiking during the recent escalations; a possible sign of weak global demand for crude.

Regardless of the September payrolls outcome, it remains possible that traders decide to trim risk holdings going into the weekend — a two-day period during which they wouldn’t be able to react to any new geopolitical developments.