Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made notable portfolio adjustments ahead of Christmas, on December 23, as revealed in daily fund disclosures. The trades reflect ARK’s continued focus on disruptive-innovation technologies such as biotech, autonomous driving, blockchain, and fintech, while trimming positions in areas showing slower growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The largest trade of the day was the purchase of 356,263 shares of Chinese autonomous driving technology company WeRide (WRD), totaling $3.19 million. Wood capitalized on the dip in WeRide shares, which declined by 1.1% yesterday.

Similarly, ARK increased exposure to gene-editing company CRISPR Therapeutics (CRSP), buying 43,333 shares for $2.50 million. CRSP stock also fell, by 2.5% yesterday.

Moreover, Wood added 333,370 shares of gene-sequencing company Pacific Biosciences (PACB). All of these buy trades follow substantial purchases in the past weeks, indicating Wood’s growing interest in disruptive technologies.

Meanwhile, Wood made a single sale of 296 shares of Ibotta (IBTA), continuing with her gradual reduction of the mobile-technology company. IBTA shares were down 2.8% the previous day and have fallen almost 67% year to date.

Wood’s Strategic Portfolio Shuffle

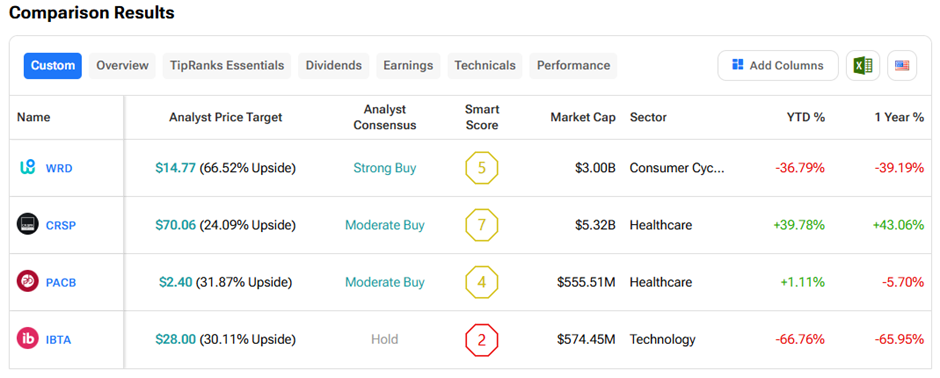

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool:

Currently, analysts have a “Strong Buy” consensus rating on WeRide, with a 66.5% upside potential over the next twelve months. Meanwhile, they remain cautiously optimistic about CRISPR and Pacific Biosciences and keep a “Hold” on Ibotta shares.