Cathie Wood’s Ark Invest snapped up additional Amazon (AMZN) shares ahead of the e-commerce and cloud computing giant’s fourth-quarter results, scheduled to be announced on January 30. Specifically, Ark Invest purchased more than 41,300 AMZN shares across two of its exchange-traded funds (ETFs). The stock purchase by ARK Invest heading into Amazon’s Q4 earnings reflects confidence in the company’s growth potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Wall Street is also bullish on Amazon’s prospects and expects the company to report a 48% year-over-year jump in Q4 2024 earnings per share (EPS) to $1.48. Analysts anticipate that solid top-line growth and margin expansion will drive AMZN’s Q4 earnings higher. Investors will pay attention to the growth in the Amazon Web Services (AWS) unit, which is expected to gain from AI-led tailwinds.

More on ARK’s Purchase of Amazon Stock

Cathie Wood’s Ark Invest purchased 41,338 AMZN shares for a total consideration of around $9.8 million based on the closing price of $238.15 on Tuesday. Specifically, the ARK Innovation ETF (ARKK) bought 23,338 AMZN shares, while the ARK Next Generation Internet ETF (ARKW) bought 18,000 shares.

Tuesday’s transaction reflects Wood’s continued interest in Amazon, as Ark Invest had purchased $1.76 million worth of AMZN shares on the previous day. Moreover, the Cathie Wood-led entity snapped up AMZN stock worth $8.9 million earlier this month.

Even after the latest purchase, Amazon is not among the top 10 holdings of ARKK and ARKW ETFs. As of January 28, the ARKK ETF held 523,478 AMZN shares, representing 1.9% of its overall portfolio. Meanwhile, the ARKW ETF held 111,266 shares of Amazon, constituting 1.43% of the fund’s overall holdings.

Is Amazon Stock a Good Buy?

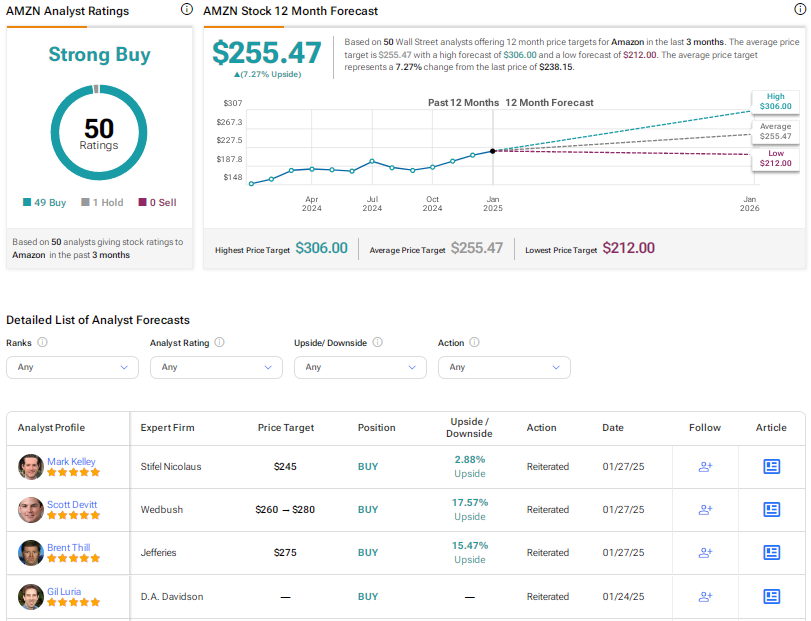

Like Wood, Wall Street is also bullish on Amazon stock, with a Strong Buy consensus rating based on 49 Buys versus one Hold recommendation. The average AMZN stock price target of $255.47 implies 7.3% upside potential from current levels.