Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made several portfolio moves across biotech and industrial names on Friday, January 9, 2026. The firm increased its exposure to early-stage biotech stocks, while trimming a major genomics name.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Which Stocks Did ARK Buy on January 9?

On the buying side, ARK’s largest move was a fresh add to Intellia Therapeutics (NTLA). The firm bought 216,411 shares, worth about $2.28 million, across its ARK Innovation ETF (ARKK) and ARK Genomic Revolution ETF (ARKG).

The purchase highlights ARK’s continued confidence in gene-editing technology, even as the biotech sector remains volatile.

Building on that, ARK also added 262,769 shares of Personalis Inc. (PSNL) through its ARK Genomic Revolution ETF (ARKG). The buy, valued at roughly $2.20 million, follows earlier purchases in the week, pointing to steady accumulation.

Outside biotech, ARK increased exposure to industrial equipment by buying 49,053 shares of Komatsu Ltd. (KMTUY), worth about $1.59 million, via its ARK Space Exploration & Innovation ETF (ARKX).

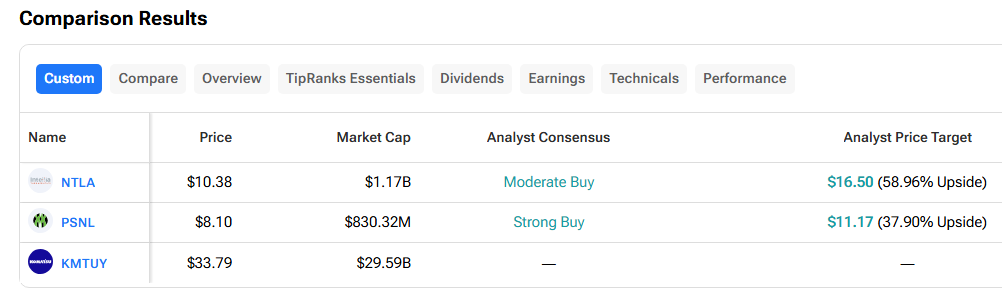

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool:

Is Illumina Stock a Buy or a Sell Now?

On the selling side, ARK trimmed its position in Illumina Inc. (ILMN), selling 14,116 shares from its ARKK ETF.

While the sale was modest, the move suggests ongoing rotation within ARK’s genomics holdings, as the firm favors earlier-stage biotech names over more established players.

Turning to Wall Street, analysts have a Hold consensus rating on ILMN stock based on four Buys, six Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 3% rally in its share price over the past year, the average ILMN price target of $124.12 per share implies 12.02% downside risk.