Cathie Wood’s ARK Invest is taking advantage of the recent dip in Tesla (TSLA) stock by purchasing 9,351 shares through its ARKK ETF (ARKK), totaling nearly $2.21 million. TSLA stock plummeted 41.5% year-to-date primarily due to weak deliveries globally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This move came despite Tesla’s recent challenges, such as a recall of over 46,000 Cybertrucks and a $1.4 billion discrepancy in capital expenditure. The purchase suggests that Cathie Wood sees these issues as temporary and believes in Tesla’s ability to overcome them and maintain its leadership in the electric vehicle (EV) market.

Other Notable Purchases of ARK

In addition, ARK acquired 100,706 shares of CRISPR Therapeutics (CRSP), worth $4.22 million. This investment points to ARK’s confidence in the gene-editing company’s growth potential.

Further, ARK purchased 103,028 shares of Iridium Communications (IRDM), valued at $2.84 million. This reflects Wood’s interest in satellite communications, a sector that plays a key role in global connectivity and technological progress.

Wood Offloads META Stock

On the other hand, ARK sold 4,648 shares of Meta Platforms (META), valued at about $2.72 million. This move aligns with ARK’s ongoing strategy to scale back its exposure to the social media giant, as seen with a larger sell-off the week before.

Further, smaller sales in Amgen (AMGN), UiPath (PATH), Repare Therapeutics (RPTX), and Veeva Systems (VEEV) indicate portfolio adjustments and profit-taking.

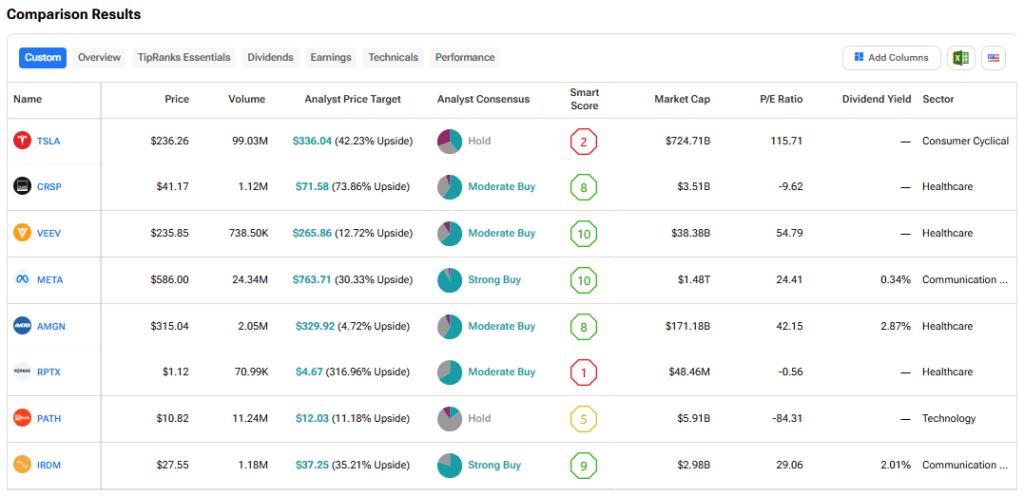

With this background, let’s see how Wood’s stocks perform on TipRanks Stock Comparison Tool based on TipRanks’ different parameters.