Cathie Wood’s ARK funds delivered a standout performance in 2025, handily beating the broader market. In her New Year’s message, Wood described 2025 as “one heck of a year.” While innovation stocks staged a powerful comeback last year, Wood believes the impact could be even more significant in 2026, setting the stage for the next phase of growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Wood, founder and CEO of ARK Invest, is known for her bullish bets on disruptive tech companies.

Cathie Wood’s 2025 Roundup

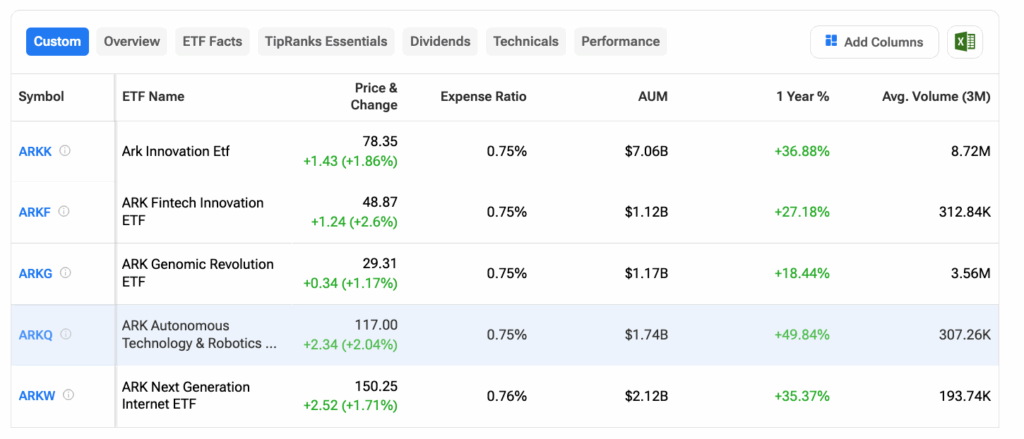

In 2025, Cathie Wood’s ARK Invest funds staged a strong comeback, clearly outperforming major U.S. benchmarks. The ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW) each gained about 35% for the year, while the ARK Autonomous Technology & Robotics ETF (ARKQ) surged nearly 50%. By comparison, the S&P 500 rose roughly 16%.

The rally was driven by her focus on disruptive technologies like AI, genomics, robotics, and blockchain.

Cathie Wood’s Investment Themes for 2026

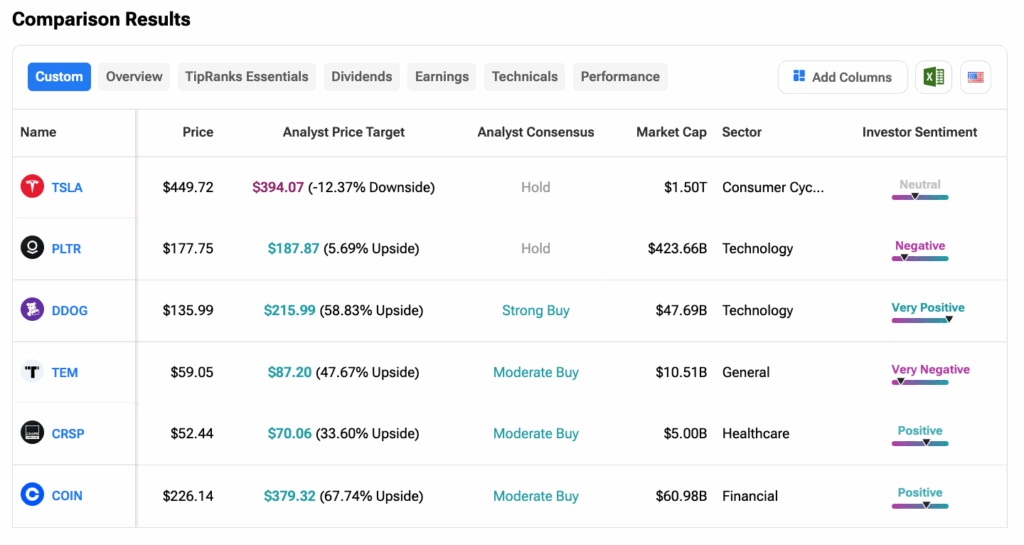

- AI remains the core of Cathie Wood’s investment thesis. She calls AI the biggest opportunity of our time, with ARK estimating it could unlock a $13 trillion software market by 2030. Wood also believes AI’s impact on healthcare is still widely overlooked. Some of ARK’s top AI-related holdings and strong performers include Palantir (PLTR), Datadog (DDOG), and Tempus AI (TEM).

- Tesla (TSLA) continues to be ARK’s highest-conviction bet and its largest holding. Wood often describes Tesla as “the largest AI project on earth,” pointing to its work in autonomous driving and robotaxis. She also described 2025 as the year of robotaxis, pointing to rapid progress by Google’s (GOOGL) Waymo and Tesla as autonomous driving technology continues to advance quickly.

- Wood also remains firmly bullish on cryptocurrencies and blockchain technology. In December, ARK funds bought nearly $50 million worth of crypto-related stocks, positioning themselves for a potential cryptocurrency rebound in 2026. Coinbase (COIN) remains a key holding, reflecting ARK’s belief in the long-term growth of crypto infrastructure.

- Wood’s latest high-conviction bets in gene editing highlight the firm’s strong belief in the game-changing potential of biotechnology. ARK Invest’s Genomic Revolution ETF has increased its stake in CRISPR Therapeutics (CRSP), betting on the long-term potential of Casgevy, an FDA-approved gene-editing treatment designed as a one-time cure for certain genetic diseases.

What Lies Ahead?

Wood wrapped up 2025 on an optimistic note, sharing a year-end message ahead of ARK’s upcoming Big Ideas 2026 report. She laid out a bullish view that rapid technological innovation could boost real economic growth. While she acknowledged there could be short-term pressure on Big Tech valuations, she pushed back on concerns about an AI bubble, noting that higher interest rates don’t automatically slow innovation.

Investors can explore these stocks using the TipRanks Stock Comparison Tool. Below is a screenshot for reference.