Cathie Wood’s ARK Invest ETFs (exchange-traded funds) are betting big on trading platform Reddit (RDDT) and Canadian e-commerce platform Shopify (SHOP), as seen in their latest trades. At the same time, Wood trimmed her stakes in TV streaming giant Roku (ROKU) and game developer Roblox (RBLX). ARK Invest operates a number of actively managed ETFs, with a focus on disruptive technology.

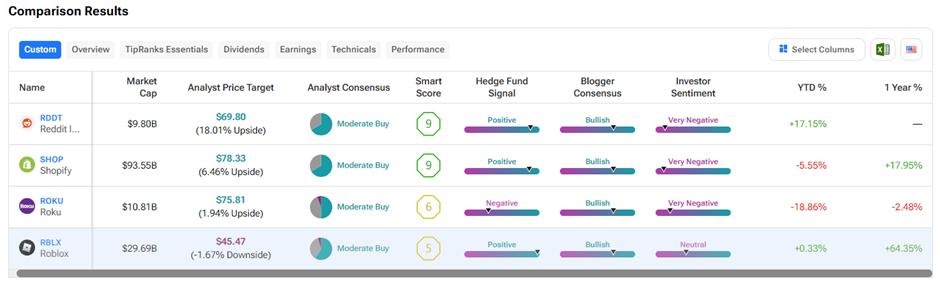

Wood is known for her unconventional investment style, which often is in contrast to Wall Street’s recommendations. As we can see from TipRanks’ Stock Comparison tool, all four of the above stocks have a Moderate Buy consensus rating, reflecting analysts’ cautious optimism on the stocks. Wood’s stance is also mostly in contrast to other hedge fund managers’ views.

Is RDDT a Buy or Sell?

ARK’s ARKW Next Generation Internet ETF bought 139,209 shares of RDDT, worth $8.23 million. Reddit stock represents only 0.99% of ARKW’s portfolio, taking the 28th spot among its holdings. As of date, ARKW holds 225,877 RDDT shares with a market value of $13.36 million.

Reddit depends heavily on advertising revenues, and the uncertain macro backdrop acts as a headwind for advertising spend. Even so, the company boasts several interesting partnerships, such as those with the NFL, NBA, and MLB, which are expected to boost advertising spend on its platform. The company also strives to increase its daily active users (DAUs) by improving its platform offerings.

On TipRanks, RDDT stock has a Moderate Buy consensus rating based on ten Buys versus five Hold ratings. The average Reddit Class A price target of $69.80 implies 18% upside potential from current levels. Since its initial listing, RDDT shares have gained 28.6%.

Is Shopify a Buy or Hold?

Wood’s ARKK Innovation ETF bought an additional 157,282 shares of Shopify, worth $11.39 million. SHOP is the fund’s ninth-largest holding, representing 3.74% of the portfolio.

Shopify is witnessing a slowdown in customer spending on its platform as macro headwinds persist. However, the company’s Merchant solutions continue to drive significant revenues.

SHOP stock has a Moderate Buy consensus rating on TipRanks, backed by 22 Buys and 11 Hold ratings. The average Shopify Class A price target of $78.33 implies 6.5% upside potential from current levels. Year-to-date, SHOP shares have lost 5.6% of their value.

Is ROKU a Buy, Hold, or Sell?

Wood sold a considerable portion of ROKU holdings from both its ARKK and ARKW funds. Together, it sold 189,990 ROKU shares, worth $14.19 million. Even after the sale, ROKU remains the #2 holding in ARKK ETF, accounting for 11% of the portfolio and valued at $625.75 million. Similarly, on ARKW, ROKU commands the #1 spot, representing 10.32% of the portfolio and valued at $139.83 million.

Wood could possibly be cashing in on the current surge in Roku’s shares. In the past three months, ROKU stock is up 37.8%. Roku will be streaming the NFL games this year and is also entering into meaningful partnerships in the sports segment.

On TipRanks, ROKU stock has a Moderate Buy consensus rating based on nine Buys, eight Holds, and one Sell rating. Also, the average Roku price target of $75.81 implies 1.9% upside potential from current levels. Year-to-date, ROKU stock is down 18.9%.

Is RBLX a Good Stock to Buy?

Similar to the ROKU sale, ARK Invest trimmed its position in Roblox stock from both ARKK and ARKW funds. The ETFs sold a combined 96,523 RBLX shares, worth $4.43 million. Following the latest sale, Roblox still remains the third-largest holding on ARKK ETF, with a 7.03% stake valued at $399.91 million. Meanwhile, Roblox is on the number 4 spot in ARKW, with a 6.73% stake valued at $91.18 million.

Roblox shares hit a new 52-week high of $47.50 yesterday, led by a tech sector rally. The company continues to report solid revenues and earnings, backed by growth in DAUs and bookings. Roblox is making enhancements to its gaming user experience, ensuring fewer game crashes and quicker load times. Roblox is a dominant player in the global gaming market.

RBLX stock has a Moderate Buy consensus rating on TipRanks based on 13 Buys, eight Holds, and one Sell rating. The average Roblox price target of $45.47 implies 1.7% downside potential from current levels. Year-to-date, RBLX shares have already gained 27.7%.