Cathie Wood’s ARK Invest ETFs (exchange-traded funds) revealed several key portfolio moves for Thursday, October 30, 2025, reflecting a pullback from big tech stocks and growing interest in industrial and biotech companies. The most notable trades included sales of Advanced Micro Devices (AMD) and Palantir Technologies (PLTR), along with a continued reduction in Iridium Communications (IRDM). On the buying side, ARK added to its positions in Deere & Co. (DE) and Pacific Biosciences (PACB), signaling renewed focus on automation and genomics.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Wood Sells Iridium, Palantir, and AMD

The biggest sale came from the ARK Innovation ETF (ARKK), which offloaded 476,280 shares of Iridium, worth about $8.06 million. This marks ARK’s third Iridium sale this week, showing continued caution toward the satellite communications stock.

ARK also sold 19,954 shares of Palantir through its ARK Space Exploration & Innovation ETF (ARKX), totaling $3.97 million. The move comes as Palantir shares have risen recently, helped by solid government contract demand.

In another tech trim, ARK sold 13,651 shares of AMD from its ARK Autonomous Technology & Robotics ETF (ARKQ), worth about $3.61 million. This follows last week’s AMD sale, suggesting ARK is locking in gains after a sharp rally in chip stocks.

ARK Buys Deere and Pacific Biosciences

On the buying side, ARK made a notable move into the industrial sector by purchasing 12,535 shares of Deere & Co. (DE) across its ARKQ and ARKX ETFs, valued at roughly $5.94 million. Deere’s growing use of automation and AI in farming equipment aligns with ARK’s focus on innovation and long-term technology trends.

ARK also boosted its position in Pacific Biosciences, adding 633,420 shares through the ARKK ETF, worth about $1.27 million. The continued buying shows Wood’s confidence in the company’s gene sequencing work and its role in the future of medicine.

In addition, ARK purchased 65,797 shares of Intellia Therapeutics (NTLA) across ARKK and ARKG, totaling $863,256, adding to its recent string of biotech investments.

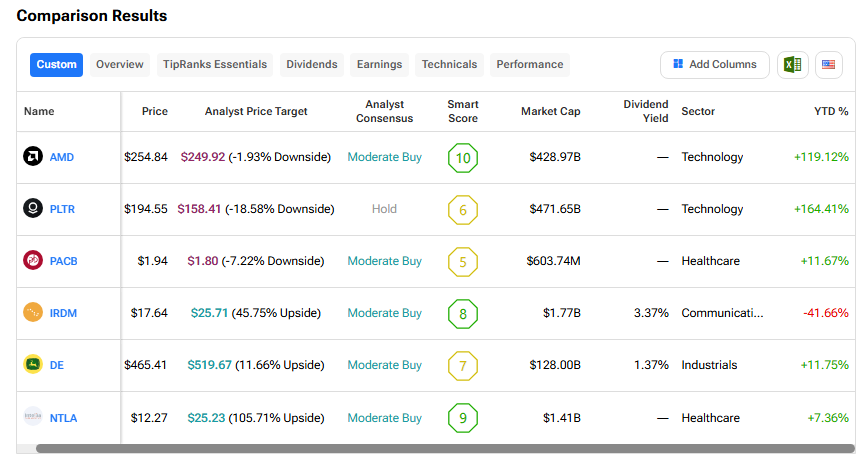

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: