Cathie Wood’s ARK Invest ETFs (exchange-traded funds) revealed several key portfolio moves for Friday, October 24, 2025, according to ARK’s daily trade disclosure. The firm reduced exposure to high-valuation tech stocks such as Advanced Micro Devices (AMD), Shopify (SHOP), and Palantir Technologies (PLTR) while adding to positions in Baidu (BIDU) and biotech names, including Pacific Biosciences (PACB) and Arcturus Therapeutics (ARCT).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ARK Locks In Profits from Top U.S. Tech Stocks

The largest transaction of the day came from the ARK Innovation ETF (ARKK), which sold 23,717 shares of AMD valued at about $5.57 million. The move follows consistent profit-taking in semiconductor stocks, as AMD shares have rallied sharply in 2025 on optimism around AI chip demand.

ARKK also trimmed 39,077 shares of Shopify, worth around $6.53 million, reflecting a broader rotation away from e-commerce plays. Meanwhile, 107,510 shares of Iridium Communications (IRDM) were sold for nearly $1.96 million, extending a selling streak that began earlier in the week.

Additionally, the fund offloaded 32,384 shares of Palantir and 26,089 shares of Roblox (RBLX), together valued at over $9 million. These sales suggest ARK is realizing gains in names that have surged this year amid growing investor enthusiasm for AI-driven platforms.

The ARK Genomic Revolution ETF (ARKG) also trimmed its holdings in Tempus AI (TEM), selling 19,391 shares worth about $1.69 million, continuing a reduction trend seen in prior sessions.

Wood Pours Millions into Baidu Stock

In contrast to the tech sell-offs, Cathie Wood showed renewed interest in Chinese internet giant Baidu. ARK funds collectively purchased 51,323 shares across the ARKK, the ARK Autonomous Technology & Robotics ETF (ARKQ), and the ARK Next Generation Internet ETF (ARKW), totaling approximately $6.18 million.

The move extends ARK’s recent accumulation of Baidu shares as the company expands its footprint in AI and autonomous driving. The purchase was ARK’s biggest trade of the day, showing strong confidence in Baidu’s growing role in China’s AI space.

Biotech Names Continue to See Strong Inflows

Beyond AI and tech, ARK’s biotech funds remained active. The ARKG fund bought 10,818 shares of Arcturus Therapeutics valued at about $130,000, continuing steady buying after recent swings in biotech stocks.

The flagship ARKK ETF also added 1.35 million shares of Pacific Biosciences for about $2.64 million, highlighting ARK’s growing confidence in next-generation sequencing technology. Additionally, ARK purchased 162,279 shares of 10x Genomics (TXG) across ARKK and ARKG for approximately $2.17 million, underscoring its continued focus on genomic innovation.

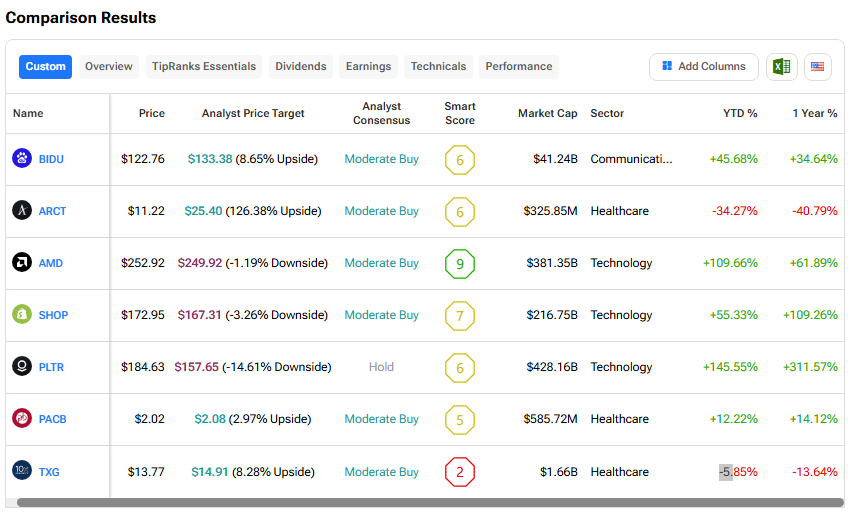

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: