Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made new trades on Thursday, November 13, according to daily fund disclosures. The standout move was a major trim in a key chip name, Advanced Micro Devices (AMD). At the same time, the fund made a big buy in Circle Internet Group (CRCL), the largest USDC stablecoin issuer, and in digital-infrastructure company Bitmine Immersion Technologies (BMNR).

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

ARK Trims AMD Position

The biggest sale came from AMD, shortly after the company detailed fresh AI and data-center plans at its 2025 Analyst Day on November 11. The event drew strong interest from Wall Street analysts and investors, sending the stock up about 10%. However, it fell 4% on Thursday to close at $247.96.

ARK sold 87,051 shares through the ARK Innovation ETF (ARKK), worth about $22.5 million. The sale marks a meaningful step back from one of the most widely held chip names and may reflect profit-taking after the recent swing in the stock.

Alongside the AMD sale, ARK also sold 572,735 shares of Pinterest (PINS) for about $15.6 million and 12,083 shares of Regeneron (REGN) worth roughly $8.2 million. It also exited 21,974 shares of Salesforce (CRM) for about $5.4 million.

ARK Steps Up Its Buying in Circle, BMNR, and Biotech

On the buy side, ARK made several notable additions. The firm increased its stake in Circle Internet, buying 188,941 shares across the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF) for roughly $16.3 million. This follows a large purchase the day before and shows growing conviction in Circle’s digital-asset platform.

ARK also boosted its crypto exposure by buying 242,347 shares of Bitmine for about $9.8 million, adding to its bet on digital infrastructure.

In biotech, ARK added 140,193 shares of Beam Therapeutics (BEAM) valued at around $3.1 million. ARK has been building this position all week, showing steady interest in gene-editing names. It also bought 261,439 shares of Recursion Pharmaceuticals (RXRX) for about $1.2 million.

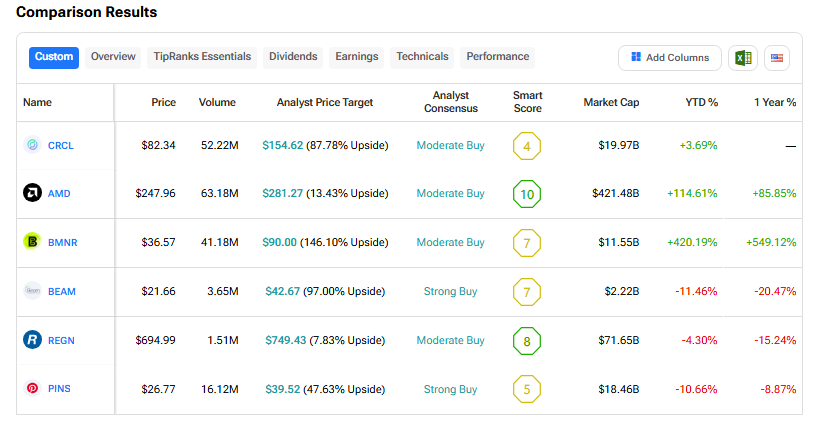

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: