AI-powered data analytics company Palantir Technologies (PLTR) has gained 163% in 2025, but has fallen about 4.6% over the past three months. On Thursday, Cathie Wood’s ARK fund sold 58,741 PLTR shares worth roughly $10 million, drawing fresh attention to the stock. The move came as Donald Trump proposed a $1.5 trillion U.S. defense budget by 2027, well above current levels. While that should support Palantir’s government-led AI business, the stock still fell 2.7% on Thursday.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, Palantir’s valuation remains the key concern. Palantir trades at a much higher multiple than most software peers, leaving limited upside unless growth stays strong. That has kept analysts split on the stock, even as the business continues to expand.

Analysts’ Mixed Views on Palantir Stock

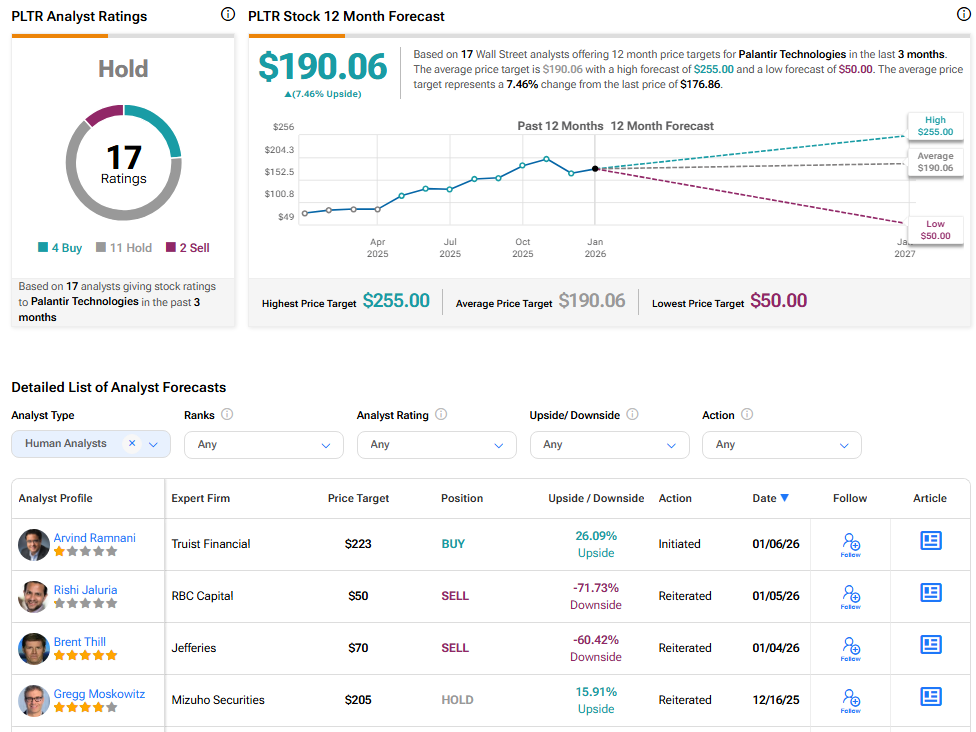

Recently, Truist Securities analyst Arvind Ramnani initiated coverage on Palantir stock with a Buy rating and a price target of $223 per share, calling it a “best-in-class AI asset.” While he flagged the stock’s high valuation, he said Palantir is well placed to drive broader use of generative AI across governments and businesses.

Ramnani pointed to strong momentum since the launch of the Palantir AI Platform, with revenue growth jumping to 63% year over year from 13% in mid-2023. He also noted operating margins have moved above 50%, showing better cost control as sales rise. Although recent gains are mostly from the U.S., he sees overseas markets as a key growth driver ahead.

In contrast, Brent Thill of Jefferies and Rishi Jaluria of RBC Capital kept Sell ratings on the stock. They see downside risk of about 60% and 72%, respectively, from current levels.

Also, Raymond James analyst Brian Gesuale reiterated a Hold rating on Palantir after the company posted strong Q3 results, with sharp growth in U.S. commercial and government revenue. Despite the solid results, the analyst remains cautious, saying the stock appears priced for perfection.

What Is the Price Target for PLTR Stock?

While Wall Street analysts believe the company has a long runway ahead, some caution that much of that future growth may already be priced into the shares.

On TipRanks, PLTR stock has a Hold consensus rating based on four Buys, 11 Holds, and two Sells assigned in the last three months. At $190.06, Palantir’s average stock price target implies an upside of 7.46% from the current level.