Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made some interesting trade moves on Thursday. The ace hedge fund manager offloaded shares of fintech trading platform Robinhood (HOOD) and American online game platform company Roblox Corp. (RBLX). The moves suggest ARK is locking in gains as both stocks have rallied lately, possibly rebalancing positions after strong price runs.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Wood Dumps Roblox Stock

On June 26, Cathie Wood’s ARK Investment sold 247,753 shares of Roblox for approximately $18.77 million, marking a notable reduction in its stake in the gaming platform.

The move likely reflects profit-taking, as Roblox shares have been on a strong run. The stock rose over 2% on Thursday and recently hit a new 52-week high, its highest level since late 2021. The rally has been fueled by growing user engagement, better monetization, and the company’s expansion into immersive digital content. Adding to the bullish outlook, Oppenheimer’s Top analyst, Martin Yang, recently raised his price target on the stock from $80 to $125 while keeping a Buy rating. The firm also sees potential in Roblox’s ad revenue and its ability to win market share from rivals.

What is Roblox Stock’s Price Target?

According to TipRanks, Wall Street has a Moderate Buy consensus rating on RBLX stock, based on 15 Buys, five Holds, and two Sells assigned in the last three months. The average Roblox stock price target of $81.45 implies a 22.43% downside potential.

Wood Offloads Coinbase Stake

Alongside Roblox, ARK Invest also trimmed its position in Coinbase, selling 33,363 shares worth about $11.86 million. The sale likely reflects a mix of profit-taking and portfolio rebalancing as crypto stocks surge.

Coinbase shares jumped 5.5% on Thursday to close at a record $375.07, topping their previous all-time high from November 2021. The rally comes amid rising optimism over the growing acceptance of cryptocurrencies. Since the Senate passed a key crypto bill last week, the stock has surged over 45%. The strong run has also caught the attention of analysts. Yesterday, Oppenheimer’s Top analyst, Owen Lau, raised his price target on Coinbase from $293 to $395, keeping a Buy rating. He sees the company as a major winner in the broader adoption of blockchain technology.

Is COIN Stock a Good Buy?

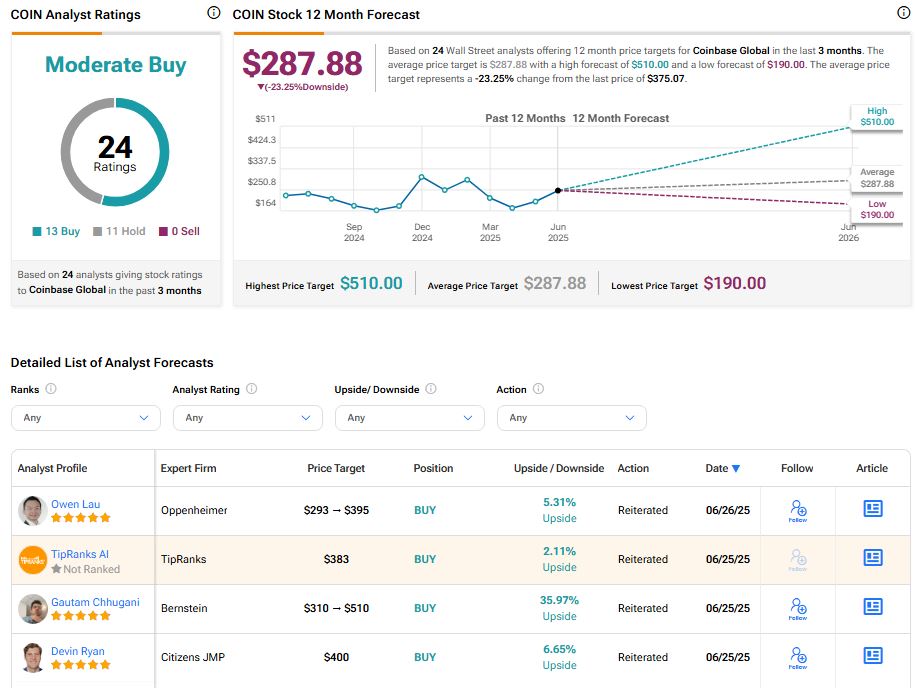

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 13 Buys, 11 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average COIN price target of $287.88 per share implies 23.3% downside potential.