Popular investor Cathie Wood and her Ark Invest funds took advantage of a buying opportunity on Tuesday by purchasing over 400,000 shares of Tempus AI (TEM) as the stock plummeted 15%. This move shows that Wood is confident in the AI healthcare firm’s long-term potential despite its recent downturn. As a result, shares of Tempus are up almost 10% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that Ark Invest acquired the shares through two of its exchange-traded funds: the Ark Innovation ETF (ARKK) and the ARK Genomic Revolution ETF (ARKG). More specifically, ARKK purchased 367,388 shares, while ARKG added 78,570 shares.

Thanks to this purchase, Tempus is now a significant position in both ARKK and ARKG. In fact, Tempus is the eighth-largest holding in ARKK, with a 4.52% weighting and a market value of $275.4 million. Meanwhile, in ARKG, Tempus is the fourth-largest holding, with a 7.5% weighting and a market value of $90.8 million.

Is TEM Stock a Good Buy?

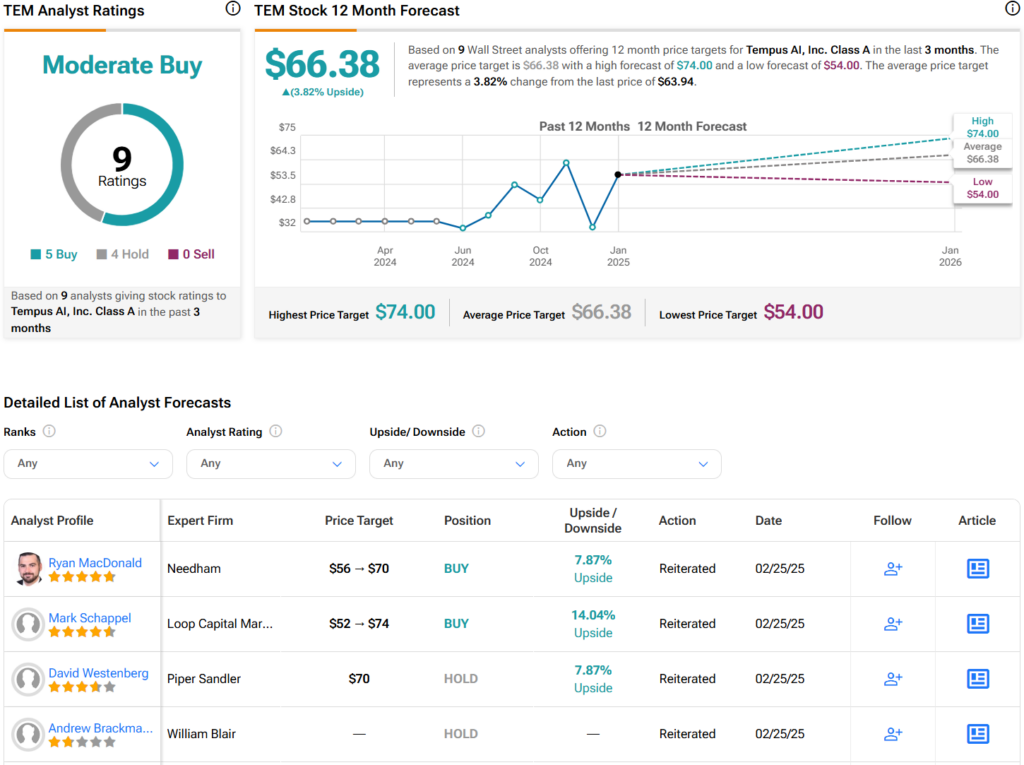

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TEM stock based on five Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 75% rally in its share price over the past year, the average TEM price target of $66.38 per share implies 3.8% upside potential.