Cathie Wood’s ARK Invest ETFs (exchange-traded funds) reported new trades on November 10. The firm trimmed its Tesla (TSLA) holdings again and added AI and chip stocks that continue to benefit from strong demand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ARK offloaded around 5,400 shares worth roughly $2.4 million across its flagship funds. The sale marks another step in Wood’s ongoing effort to rebalance Tesla’s heavy weighting in ARK’s portfolio.

Tesla shares have remained volatile in recent sessions as investors weigh slower deliveries and rising EV competition. Notably, Tesla’s China-made electric vehicle (EV) sales declined 9.9% year-over-year to 61,497 units in October and plunged 32.3% compared to the previous month, according to data from the China Passenger Car Association (CPCA).

(Note: To see more of Cathie Wood’s November 10 trades, click here — Cathie Wood Sells Tesla (TSLA) Stock, and Buys This Stock after Q3 Beat.)

Buys in AI and Semiconductor Names

On the buy side, ARK added 173,798 shares of Pony AI (PONY), valued at about $2.5 million, showing confidence in the self-driving technology space. The fund also bought 16,598 shares of Taiwan Semiconductor (TSM), worth around $4.9 million, as chip demand tied to AI continues to grow.

Another major purchase came from Baidu (BIDU), where ARK picked up 94,095 shares valued at about $12.4 million. The move signals renewed interest in Chinese AI firms after recent market weakness.

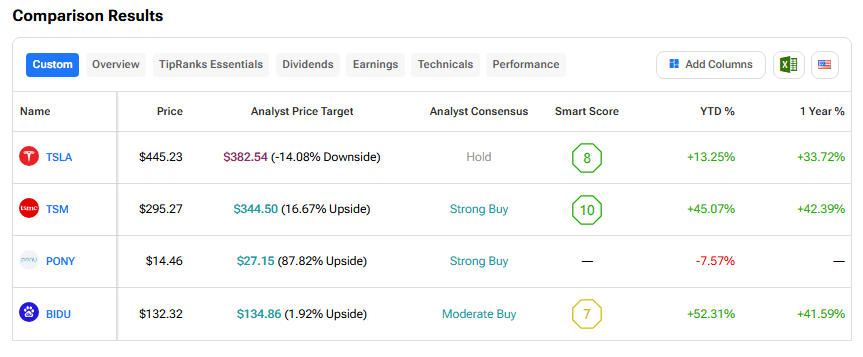

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: