Ace hedge fund manager Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made some interesting portfolio adjustments on Monday, September 8, according to the funds’ daily disclosures. Yesterday, Wood continued to build her position in Ethereum (ETH-USD)-focused crypto stock BitMine Immersion Technologies (BMNR), while trimming stakes in Robinhood Markets (HOOD) and Teradyne (TER).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wood Boosts Stake in BitMine Immersion Stock

BitMine Immersion remains one of Wood’s top bets. On Monday, the ARK Innovation ETF (ARKK), the ARK Next Generation Internet ETF (ARKW), and the ARK Fintech Innovation ETF (ARKF) purchased 67,700, 21,890, and 12,360 BMNR shares, respectively. Collectively, these three ARK ETFs bought 101,950 shares of BitMine Immersion for about $4.29 million.

Yesterday, BitMine Immersion announced that its crypto and cash holdings surpassed $9.21 billion, as of September 7. Notably, BMNR’s crypto holdings include 2,069,443 ETH, 192 Bitcoin (BTC-USD), and “unencumbered cash” of $266 million. BitMine highlighted that it remains the largest Ethereum treasury in the world and the second-largest global treasury company, behind Strategy (MSTR), which owns 636,505 BTC worth $71 billion. BMNR believes that Wall Street’s growing adoption of blockchain and the rise of artificial intelligence (AI)/agentic AI are creating a “supercycle” for Ethereum.

BitMine Immersion also announced a $20 million investment in Eightco (OCTO), as part of its strategy to support innovative projects that create value for the Ethereum ecosystem.

Is BMNR Stock a Good Buy or Sell?

Currently, Wall Street has a Moderate Buy consensus rating on BitMine Immersion stock based on ThinkEquity analyst Ashok Kumar’s Buy recommendation. Kumar’s BMNR stock price target of $60 indicates 37% upside potential. BMNR stock has rallied more than 461% year-to-date.

Wood Offloads Robinhood and Teradyne Shares

On Monday, ARK Invest’s ARKW ETF offloaded 43,728 shares of trading platform Robinhood Markets for about $4.43 million. Interestingly, HOOD stock surged about 16% yesterday, as investors cheered the news of its inclusion in the S&P 500 Index (SPX). HOOD stock has rallied 215% so far this year.

Furthermore, the ARKK ETF sold 9,896 shares of semiconductor-testing equipment maker Teradyne, worth $1.19 million. TER stock is down about 6% year-to-date.

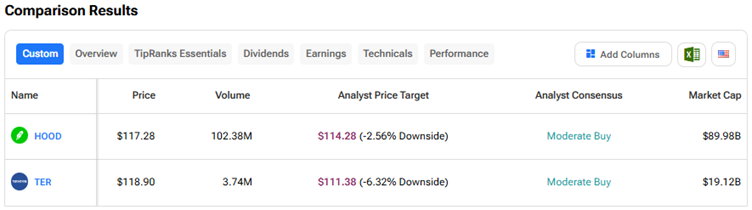

Let’s look at the ratings for these two stocks using TipRanks’ Stock Comparison Tool.

Currently, Wall Street has a Moderate Buy consensus rating on both Robinhood and Teradyne stocks. Analysts see a possible downside of 3% and 6.3% in HOOD and TER stocks, respectively.