Hedge fund manager Cathie Wood is buying the dip in Baidu (BIDU) stock through her ARK Invest ETFs (exchange-traded funds). Wood’s Next Generation Internet ETF (ARKW) and ARK Autonomous Technology & Robotics ETF (ARKQ) collectively purchased a total of 129,451 shares of Baidu, valued at nearly $12.24 million. At the same time, the ARKW ETF sold a significant portion of its Roblox (RBLX) stock holding, shedding 78,406 shares for $4.79 million. These trades were disclosed through ARK’s daily trade updates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Other notable trades from March 24 included the purchase of 143,163 shares of Beam Therapeutics (BEAM), worth $3.34 million, and the acquisition of 140,602 shares of Iridium Communications (IRDM), valued at $3.89 million. On the other hand, ARK offloaded a portion of Ansys (ANSS), selling 15,281 shares for $4.95 million.

Is BIDU a Long-Term Investment?

Baidu stock has dropped 7.9% in the past five-trading sessions, presenting an attractive opportunity to buy the stock. Baidu operates China’s largest search engine and is one of the leading players in the AI (artificial intelligence) race. The tech giant recently launched deep-thinking reasoning AI model, Ernie X1, and the advanced version of its foundational model, Ernie 4.5, challenging peers like OpenAI and DeepSeek. Baidu has claimed that the Ernie X1 “delivers performance on par with DeepSeek R1 at only half the price.”

Notably, Baidu made headlines today by announcing a strategic partnership with battery maker CATL to explore and develop autonomous vehicles, digitalization, and AI for driverless mobility solutions.

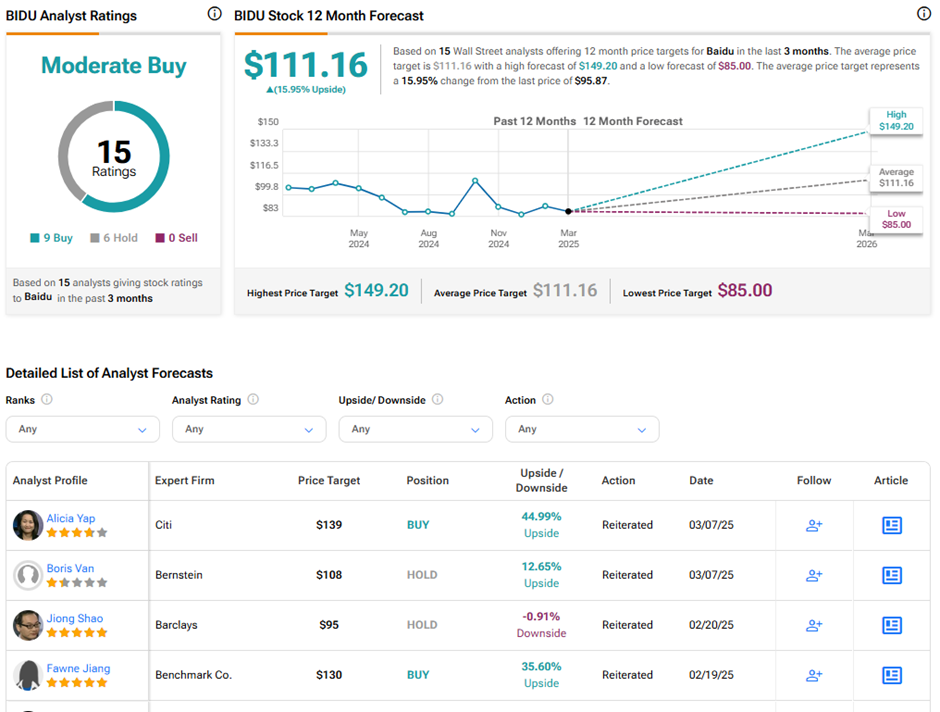

However, Wall Street remains divided on Baidu’s stock trajectory. On TipRanks, BIDU stock has a Moderate Buy consensus rating based on nine Buys and six Hold ratings. Also, the average Baidu price target of $111.16 implies nearly 16% upside potential from current levels. In the past year, BIDU stock has lost 9.3%.

Is RBLX a Good Stock to Buy?

Analysts remain cautious of Roblox’s declining bookings and disappointing user engagement metrics, including hours spent on the app. On TipRanks, RBLX stock has a Moderate Buy consensus rating based on 13 Buys, five Holds, and two Sell ratings. The average Roblox price target of $69 implies 12.8% upside potential from current levels. RBLX stock has gained 66.9% in the past year.