Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made several notable portfolio adjustments on Thursday, October 23, according to daily fund disclosures. The prominent hedge fund manager continued to accumulate shares of Chinese tech giants Alibaba (BABA) and Baidu (BIDU), as well as biotech firm Arcturus Therapeutics (ARCT).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On the other hand, Wood reduced exposure to Advanced Micro Devices (AMD), SoFi Technologies (SOFI), and Shopify (SHOP). She also made smaller sales in Kratos Defense (KTOS), Iridium Communications (IRDM), Tempus AI (TEM), Roblox (RBLX), and Roku (ROKU).

Wood Pours Millions into Chinese Tech Stocks

Wood continues to display strong conviction in Chinese technology leaders, Alibaba and Baidu, signaling renewed confidence in China’s digital economy despite persistent U.S.–China trade tensions and investor caution surrounding Chinese equities.

On Thursday, she purchased 68,939 shares of Chinese e-commerce giant Alibaba amounting to $11.43 million, marking ARK’s largest trade of the day. The purchases were spread across the ARK Innovation ETF (ARKK), the ARK Fintech Innovation Fund (ARKF), and the ARK Next Generation Internet ETF (ARKW) funds.

In addition, she acquired 54,194 shares of internet giant Baidu, totaling $6.34 million across the ARKK, ARKW, and the ARK Autonomous Technology & Robotics ETF (ARKQ) funds. These moves reflect ARK’s growing interest in the AI and cloud computing capabilities of major Chinese internet companies, both of which have expanded aggressively in generative AI in 2025.

Wood Buys the Dip in Arcturus

Arcturus is a commercial mRNA medicines and vaccines company. On October 22, the biotech firm disclosed disappointing results from its mid-stage trial of ARCT-032, an mRNA-based treatment for cystic fibrosis. The company stated that treatment-related adverse events occurred during the initial dosing phase but subsided with continued administration. This caused ARCT stock to plunge over 57%.

Wood has capitalized on this dip and acquired 223,292 shares via the ARK Genomic Revolution ETF (ARKG) on Wednesday and added another 297,766 shares valued at $3.43 million yesterday. Her move suggests a long-term bet on the mRNA technology platform’s potential beyond short-term clinical setbacks.

ARK Trims AMD, SOFI, and SHOP Holdings

The ARKW ETF sold 9,910 shares of AMD for $2.28 million. AMD is set to report its Q3FY25 results on November 4 and analysts remain divided on the chipmaker’s long-term prospects. ARK had already sold AMD shares worth about $11 million on October 22, realizing gains from the stock’s recent rally.

Wood also offloaded 22,759 shares of fintech company SoFi ahead of its Q3 results due on October 28. Additionally, she sold 10,829 shares of Canadian e-commerce platform Shopify for $1.75 million. The continued trimming of Shopify reflects ARK’s broader strategy to reallocate capital toward high-growth innovation areas, including AI, genomics, and next-generation internet technologies.

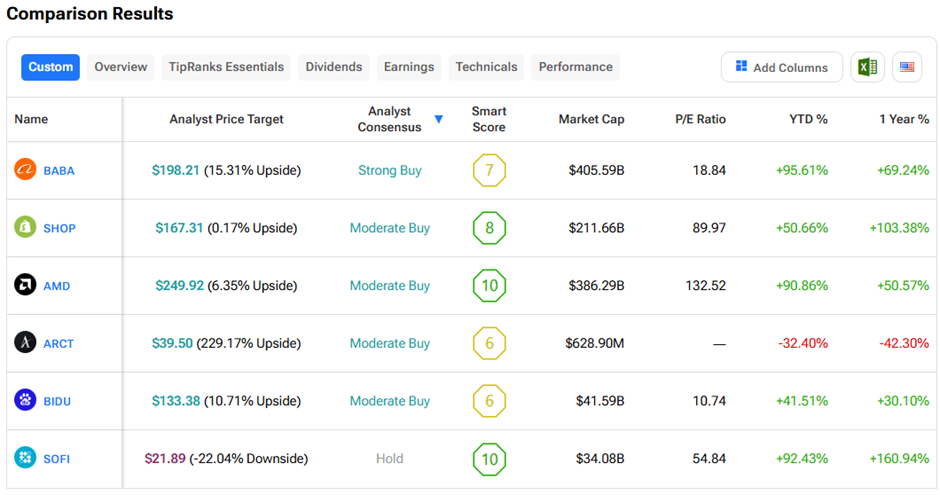

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: