Caterpillar (CAT) stock might be considered a ‘steady Eddie‘ type of asset, but falling interest rates could prove to be a game changer for the company and its shareholders. I am bullish on CAT stock because the business is fundamentally solid, the company is known for increasing its dividend payouts, and changing interest-rate policy should provide a tailwind.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Caterpillar is a giant company that produces and sells construction equipment. I wouldn’t say that Caterpillar is the world’s most exposed company to interest rate movements, but a more accommodative central bank policy certainly won’t hurt. Not only does CAT operate in an interest rate-sensitive industry, but lower rates will limit the amount of interest expense the company pays on its debt.

Just as importantly, I don’t view Caterpillar as overvalued despite the fact that the stock trades near an all-time high, as do major U.S. stock-market indexes. I believe that CAT stock actually provides good value here.

Turn to Caterpillar for Good Value and Yield

A tried-and-true valuation metric can help us decide whether Caterpillar is currently overvalued or not. Caterpillar’s GAAP-measured trailing 12-month price-to-earnings (P/E) ratio is 17.5x. This is favorable when compared to the sector median P/E ratio of 24.3x and Caterpillar’s five-year average P/E ratio of 19.74x. I’d come to the same conclusions using non-GAAP (adjusted) P/E ratios.

Income-focused investors will see that Caterpillar offers a decent forward annual dividend yield of 1.36%. Moreover, when I scrolled down through TipRanks’ Dividend page for Caterpillar, I discovered that the company has a long-standing track record of hiking its dividend distributions. Even if Caterpillar doesn’t pay a gigantic dividend, at least the company is known for sustaining its dividend and growing it over the long term. That’s a major confidence builder.

Caterpillar Is an Earnings-Beat Machine

Of course, I don’t want to just chase value or yield. I want to feel confident that Caterpillar is a financially sound business. That way, I can build my bullish case for CAT stock. In reviewing the earnings page and the financials page for Caterpillar, the first thing I noticed is that Caterpillar appears to be an “earnings beat machine.” For the past six consecutive quarters, Caterpillar has beaten Wall Street’s consensus EPS estimate. That lends confidence to the belief that the company can afford to continue raising its dividend payouts.

Turning to the Financials page, I observed that Caterpillar’s revenue has been relatively steady over the past five quarters. Moreover, the company’s free cash flow (FCF) has stayed within a range. There have been fluctuations, but nothing too startling.

Of course, all of this could change when Caterpillar releases its Q3 2024 financial results on October 24. Wall Street hasn’t set an excessively high bar for Caterpillar, though. The analysts’ consensus estimate calls for Caterpillar to earn $5.36 per share, which would be down from an EPS of $5.52 the year prior. Earnings expectations are also for a drop from Q2’s bottom line of $5.99 per share. It’s entirely possible that Caterpillar will meet or beat Wall Street’s expectations again, of course.

More Rate Cuts Should Provide a Tailwind for Caterpillar

The prospect of further interest-rate cuts helps bolster my bullish view of CAT stock. No one knows exactly what the Federal Reserve will do in future Federal Open Market Committee (FOMC) meetings. However, when the Federal Reserve enacted a “jumbo” 50-basis-point interest-rate cut recently, this seemed to signal a pivot to a more accommodative monetary policy.

The Federal Reserve’s path should help Caterpillar because when interest rates are reduced, mortgage interest rates usually decline. Lower mortgage rates incentivize home building and home buying. Recent data from Freddie Mac indicated that the U.S. 30-year mortgage interest rate is currently 6.12%. That rate was up to 8% in the not-so-distant past. If the Federal Reserve continues its path of interest-rate cuts, it should further spur activity in the home-building sector, which would be of great help to Caterpillar and its shareholders.

Is CAT Stock a Buy, According to Analysts?

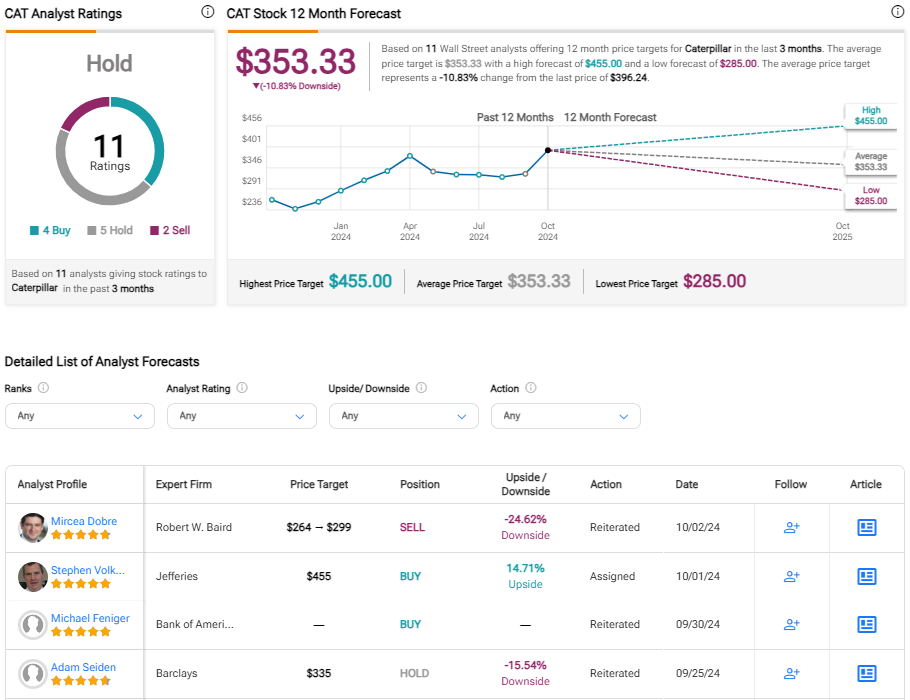

On TipRanks, CAT comes in as a Hold based on four Buys, five Holds, and two Sell ratings assigned by analysts in the past three months. The average CAT price target is $353.33, which is more than 10% below its recent trading price.

If you’re wondering which analyst you should follow if you want to buy and sell CAT stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jamie Cook of Truist Financial, with an average return of 29.54% per rating and an 84% success rate.

Conclusion: Should Investors Consider CAT Stock?

In utilizing TipRanks’ online tools, I noted that Caterpillar is in reasonably good financial condition. I believe that Caterpillar has a good opportunity to beat Wall Street’s EPS forecast when the company releases its third-quarter 2024 financial results a few weeks from now on October 24.

Caterpillar has a track record of occasionally raising its dividend distributions. Additionally, an old-school metric indicates that Caterpillar isn’t too richly valued. Despite CAT stock trading near an all-time high, its P/E ratio is below that of the market averages. A further reason to be optimistic about CAT is the Federal Reserve’s likely continuation of Fed Funds Rate cuts. I would certainly consider purchasing Caterpillar shares at the present time.