Shares of Caterpillar (NYSE: CAT) fell in pre-market trading even as the engineering equipment manufacturer delivered better-than-expected results in the third quarter, but its order backlog declined by $1.9 billion year-over-year. At the end of the third quarter, the company had an order backlog of $28.1 billion.

The company’s adjusted earnings came in at $5.52 per share, up by 39.7% year-over-year, which beat analysts’ consensus estimate of $4.80 per share.

Caterpillar’s sales increased by 12% year-over-year to $16.8 billion, surpassing analysts’ expectations of $16.6 billion. The rise in sales was due to the “increase was due to favorable price realization and

higher sales volume.” The jump in sales volume was driven by “higher sales of equipment to end users.”

Is CAT Stock a Good Buy Now?

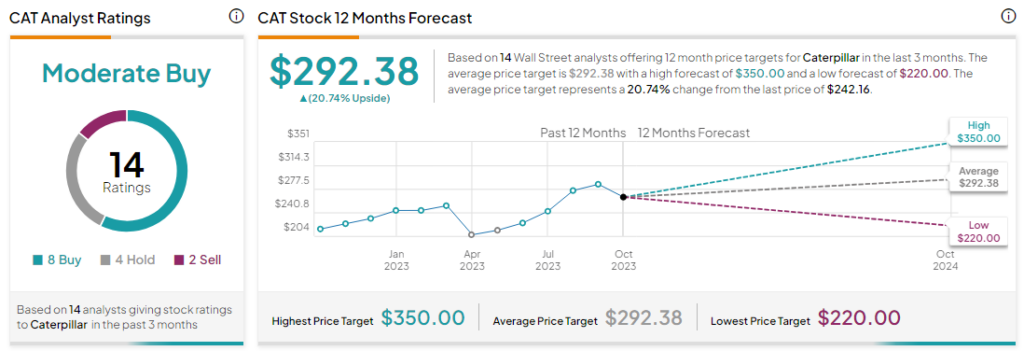

Analysts remain cautiously optimistic about CAT stock with a Moderate Buy consensus rating based on eight Buys, four Holds and two Sells. The average CAT price target of $292.38, implies an upside potential of 20.7% at current levels.

Questions or Comments about the article? Write to editor@tipranks.com