Advanced Micro Devices (NASDAQ:AMD) has certainly had its share of heartache recently. The chipmaker has been bruised by fierce competition with Nvidia, trade disruptions, tariff battles, and tightening export rules targeting China. A 32% drop in the stock over the past 12 months tells the story.

But with AMD set to report its Q1 FY 2025 results on Tuesday, May 6, at least one voice sees a window of opportunity. JR Research, a well-followed investor, believes that the downside is already factored in and that now might be the perfect time to pounce.

“AMD’s valuation is attractive,” asserts the 5-star investor. “The market has priced significant risks against its cyclicality.”

Fears of a capital expenditure (capex) slowdown have been mounting amid broader economic uncertainty and rising trade tensions.

Addressing fears of a capex slowdown, the investor notes that the recent earnings reports from the big tech companies have demonstrated that these worries appear to be overblown. In fact, JR points out that Meta even raised its capex spending outlook.

Now, JR is hoping that AMD’s management will give further support for this positive movement on the upcoming earnings call through bullish guidance – particularly for the company’s data center business. JR adds that this segment now comprises some 50% of AMD’s revenues and had been showing healthy rates of growth throughout the past few quarters.

The investor thinks that with a forward EBITDA multiple of 21.2x, AMD may never be this cheap again.

“The market appears ready to reallocate exposure to AMD’s battered valuation, suggesting AMD might continue to gain momentum,” concludes JR Research, who rates AMD shares a Buy. (To watch JR Research’s track record, click here)

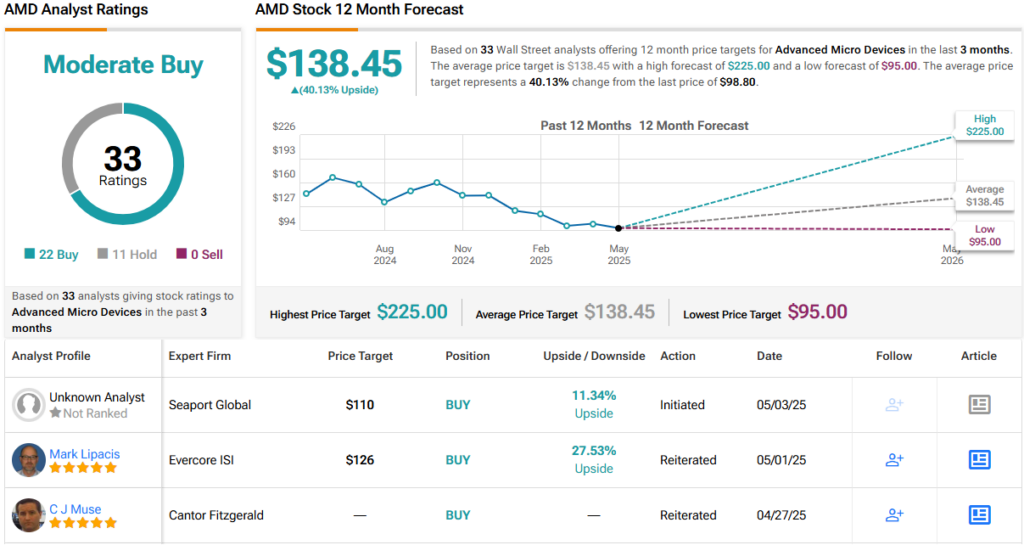

Wall Street appears to agree with this take. With 22 Buy and 11 Hold recommendations, AMD claims a Moderate Buy consensus rating. Its 12-month average price target of $138.45 translates into gains of 40%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.