Casino stocks rose across the board Thursday after MGM Resorts (MGM) posted a fourth-quarter earnings and revenue beat. The Las Vegas casino operator topped analysts’ estimates on both the top and bottom lines after getting a boost from China, sending MGM stock up more than 17% on the session, its best day since March 2020.

Other casino stocks followed suit with Caesars Entertainment (CZR) up 9% for the day, while Las Vegas Sands (LVS) rose nearly 1%. Wynn Resorts (WYNN), which reported earnings after Thursday’s closing bell, was nearly 3% higher on Thursday and extended gains after earnings.

MGM Lets The Good Times Roll

China and digital growth saw MGM Resorts report record full year consolidated net revenues, up 7% to $17.2 billion. Earnings per share for its Fiscal fourth quarter came in at $0.45, topping analyst estimates of $0.32 per share.

MGM China revenues rose 28% to $4 billion, making it the second-highest revenue generator behind the Las Vegas Strip. Fourth quarter net revenues in China rose 4% to $1 billion compared to $983 million. However, revenues from the Las Vegas Strip fell 6% to $2.2 billion.

The company also saw progress in digital channels and said its BetMGM venture in North America is expected to be profitable this year.

CEO Bill Hornbuckle said he is “encouraged by the strong demand we’re seeing in the business so far in 2025, which positions us well for continued growth.”

Meanwhile, WYNN reported that Macau growth boosted revenue by 9% last year to $7.13 billion, although Fiscal fourth-quarter revenues were flat year-on-year.

Is MGM a Buy or Sell?

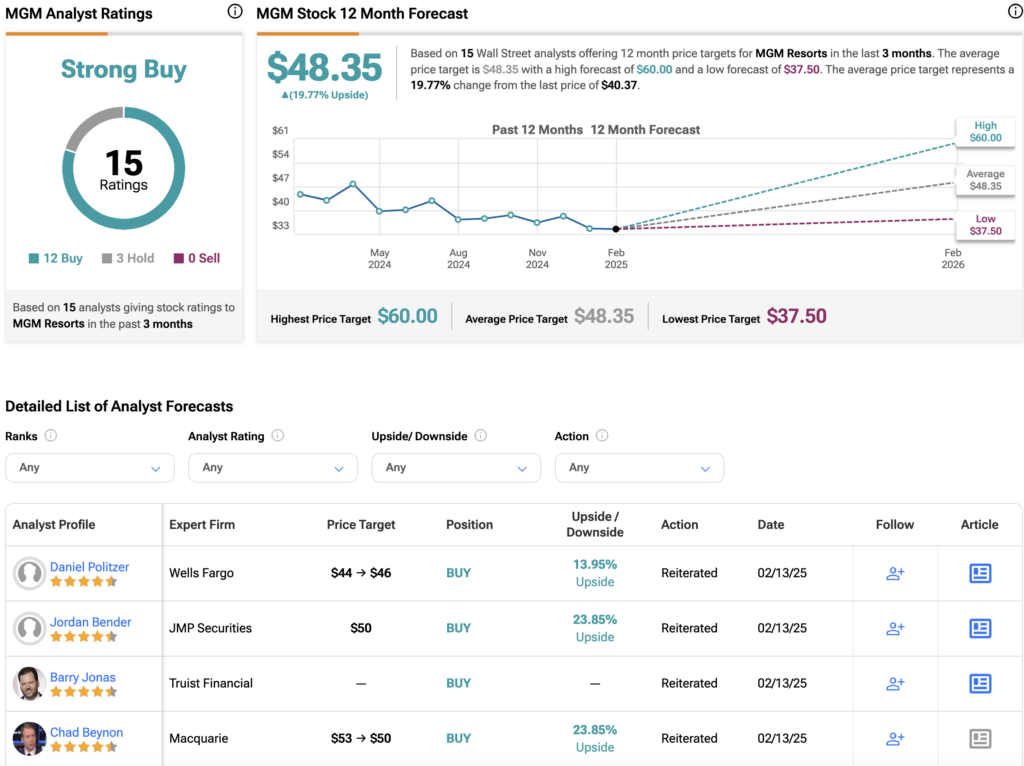

Analysts on Wall Street have a Strong Buy consensus rating on MGM stock based on 12 Buys, three Holds, and zero Sells. The average MGM price target of $48.35 per share implies about 20% upside potential.