Circumstances aren’t working in favor of aerospace juggernaut Boeing ($BA), that much is obvious. Several days ago, the once proud icon announced that it has withdrawn latest its contract offer to its machinists, who are striking in an effort to extract better overall compensation. As TipRanks contributor Steve Anderson noted, the strike represents but one of many problems impacting BA stock.

Boeing Is struggling with a cash crunch and this dilemma might worsen. A Bloomberg report stated that S&P Global Ratings is poised to drop the aerospace giant’s credit rating to “junk” status. If that wasn’t bad enough, stakeholders of BA stock are getting used to new CEO Kelly Ortberg, who took the helm of the company in August this year.

Adding insult to injury, Boeing recently said that it won’t deliver its latest 777X widebody airplanes until 2026, at the earliest. That would put production of this aircraft six years behind schedule. It doesn’t appear that management has many great answers right now. As such, I’m bearish on BA stock. But there’s a smart way to go short and profit with this security.

Benefits of a Bear Call Spread with BA Stock

Because I’m bearish, I see two baseline mechanisms available to profit on BA stock: you can buy a put option, which would give you the right (but not the obligation) to sell the underlying asset at the listed strike price. This is a debit-based approach. The other mechanism is to sell a call option or selling the right to buy the underlying asset, which is a credit-based approach.

Of course, selling a call option presents extraordinary risks. First, if the trade moves against you, you risk assignment, which is when the other party can exercise their option and you must fulfill the terms of the option contract. Second, a security theoretically carries no upside ceiling so selling calls runs the risk of unlimited liability (though you’ll likely get margin called before this situation occurs).

So, how do you enjoy the benefits of selling calls while controlling the risk? The answer is the bear call spread. On the same expiration date, you sell a call and simultaneously buy a call at a higher strike price. Should the trade move against you, the higher-strike call (i.e. long call) counteracts the obligation of the short call. You instead lose the difference in the strike prices minus the income received in selling the call spread.

Leveraging Inefficiency in BA Stock Options

While a bear call spread makes sense if you’re bearish on Boeing stock, investors must still recognize some of the challenges associated with this options bet. For one thing, you must be somewhat confident in the pessimistic narrative. A smart framework in the wrong direction will still yield a loss. Moreover, there are many individual call spreads to choose from. It then begs the question, which one should you consider?

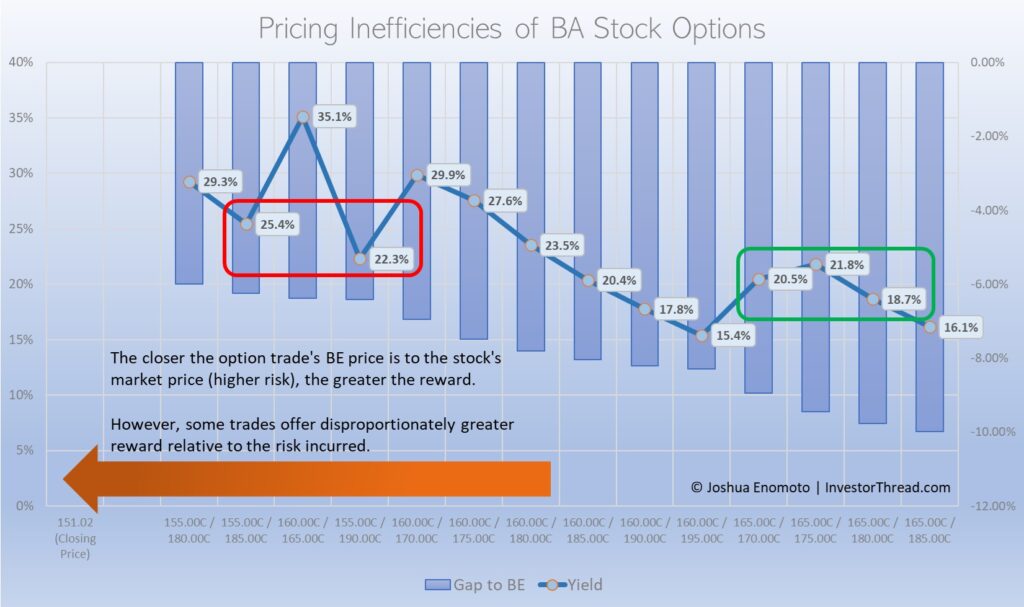

To answer this specific question, we can turn to the science of inefficiency. If pricing dynamics in the options market were perfectly rational and efficient, we would expect a correlation of 100% between risk and reward; that is, for every measure of risk accepted, the trade should yield a proportionate measure of reward. However, that’s generally not how options work: there are usually inefficient trades that either work for you or against you, as illustrated in the graphic below.

For BA stock, the correlation coefficient between call spread yields and the individual trades’ gap to the breakeven price clocks in at 85%. That’s high but that also means there’s a 15% inefficiency that astute traders (i.e. TipRanks subscribers) can exploit for their advantage. And that’s where I’d like to turn to next.

Not All Boeing Option Tickets are Equal

Finding the right bear call spread when bearish on a stock like Boeing can be a hassle. You may be pessimistic but you also want to give yourself some margin of safety in case the market moves against you. With BA stock, TipRanks’ options algorithm identified the possibility of a 7.91% move (either to the upside or down) following Boeing’s Oct. 23 earnings report. That means we need to give ourselves an 8% cushion.

To achieve this, interested speculators may consider the 165/170 bear call spread that expires on Nov. 15. This transaction involves selling the $165 call and simultaneously buying the $170 call. Following Friday’s close, the bid on the short call was $3.75 and the ask on the long call was $2.90. The maximum reward possible is the income received of 85 cents whereas the maximum loss comes out to $4.15. Breakeven is $165.85.

Essentially, BA stock can move up almost 10% — which is against our bearish position — and still be somewhat profitable. Further, for this safety margin, you would also receive a maximum yield of 20.48% should Boeing stock hit or stay below the short call strike price of $165. That’s a rare combination of yield and protection.

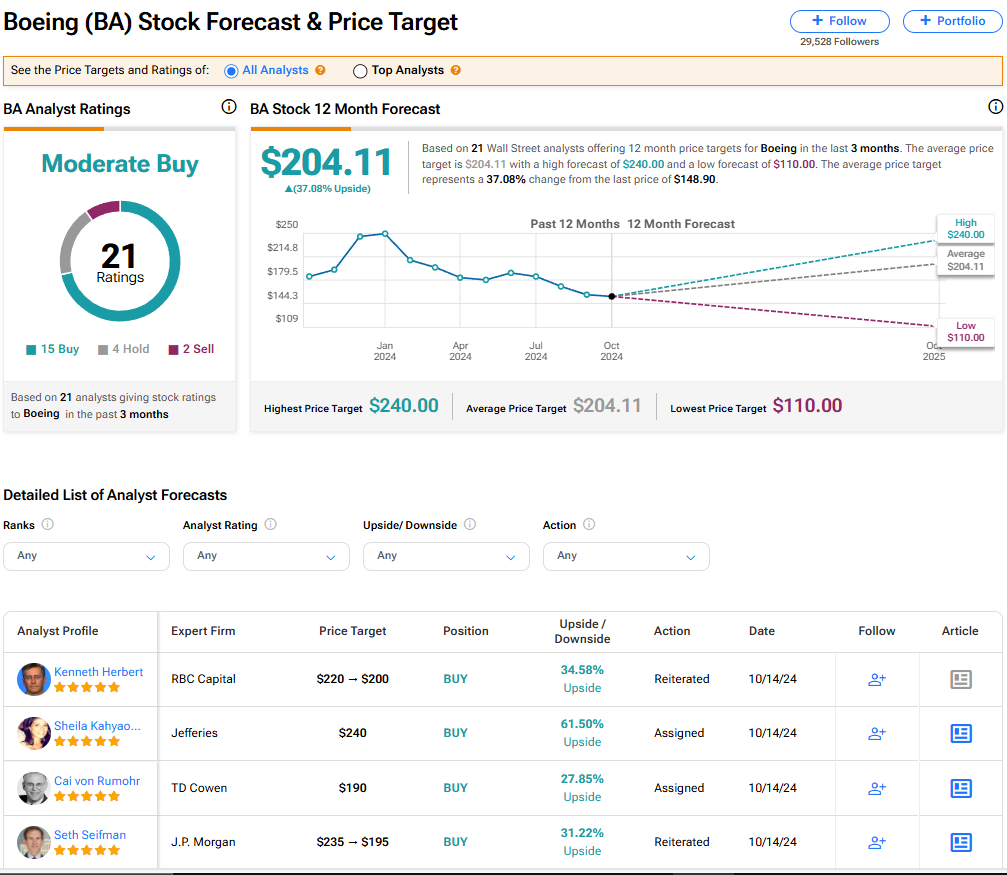

Wall Street’s Take on Boeing

Turning to Wall Street, BA stock has a Moderate Buy consensus rating based on 15 Buys, four Holds, and two Sell ratings. The average BA price target is $204.11, implying 35.15% upside potential from current levels.

Read more analyst ratings on BA stock

Conclusion: Bet on a Rough Landing for BA Stock

With cash flow problems and other headwinds impacting Boeing, the aerospace giant isn’t having a great time right now. As the company’s troubles look likely to continue, a bear call spread against BA stock could be the right move. However, there’s a smart way to go about this short position and it’s best to leverage the inefficiencies in the options market to achieve a favorable outcome.