Carvana (NYSE:CVNA), a popular online used car retailer, is continuing to attract Wall Street analysts who see more upside for the company based on its improving operating performance, even on the back of a 349% stock price gain in the past 12 months. Carvana, back in late 2022, was facing the risk of bankruptcy, as the company had limited access to cash to service its massive debt pile. On cue, Carvana stock dropped to just $4 in December 2022 after reaching a peak of over $350 in 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Today, the company is on much better footing despite a mixed macroeconomic outlook, but I am neutral on Carvana, as I believe the current valuation leaves little margin of safety for investors.

Carvana Is Bucking Industry Trends

The used car industry in the U.S. is facing several headwinds today, including high interest rates that have capped the spending power of consumers, persistently high inflation that has dampened consumer sentiment, and inventory normalization with dealerships now seeing their inventories rise after record shortages during pandemic days. The Manheim Used Vehicle Value Index, a popular measure of the general price level of used cars in the U.S., declined to 196.8 recently from a high of over 250 in 2022 amid these challenges.

Despite these macroeconomic challenges, Carvana delivered its best-ever financial performance in Q1, suggesting that the company is bucking industry trends. Carvana’s adjusted EBITDA margin improved to 7.7%, which was the highest among publicly listed auto retailers in the nation in Q1. All key performance indicators improved in Q1, including a 16% increase in retail units sold to 91,878, a 17% increase in revenue to $3.06 billion, and a 73% improvement in gross profit to $591 million.

Diving deeper into Carvana reveals that this industry-defying success came on the back of the company’s aggressive investments in the past. Carvana’s data-driven approach and the seamless online platform, which reduces overhead costs such as maintenance fees and yard rentals, have been instrumental in recent profit margin expansion. Despite a 21% unit sales increase in Q1 compared to the previous quarter, overhead expenses remained flat, resulting in overhead expenses as a percent of revenue declining from 6.2% to 4.9%.

The Unique Business Model Is Coming to the Rescue

Carvana’s business model has unique characteristics that separate it from its closest rivals, and these factors have aided its growth amid challenging conditions in the recent past.

Carvana, unlike other auto retailers, purely functions as an online retailer, enabling the company to keep costs limited despite inflationary pressures. The company also has a nationwide customer reach, potentially helping it benefit from scale advantages. This massive reach helps Carvana offset the weakness in one market with the strength of another. Vehicle dealerships typically focus on one geographic location, and their fortunes are usually tied to the health of their primary market.

The Focus on Profitability Is Encouraging

Carvana, until the end of 2022, was laser-focused on growing aggressively. Since then, the company has taken a step back to focus on profitable growth, and this new strategy has already delivered promising results.

In Q1, the company turned profitable and reported a net income of $49 million, but this included a $75 million gain from the increase in fair value of stock warrants to acquire Root (NASDAQ:ROOT) shares. Carvana’s net income margin has been steadily increasing since 2023, with the firm cutting back on operating expenses to drive margins higher.

Carvana’s focus on sustainable growth will prove handy in the future if used car market dynamics hinder aggressive scaling and cash flow generation for debt servicing.

The Expensive Valuation

Carvana is trading at a forward GAAP P/E of 69x today, but this does not help a lot in understanding the company’s true valuation level, as CVNA is just starting to be profitable today. A better approach is to compare Carvana’s valuation with a well-established auto retailer such as CarMax (NYSE:KMX).

CarMax is currently valued at a P/S multiple of just 0.4x compared to 1.1x for Carvana, which suggests the latter is already trading at premium valuation multiples, which account for its industry-leading growth.

Although Carvana has so far weathered macroeconomic challenges well, the company’s massive long-term debt pile of around $5 billion may prove to be an obstacle if it fails to generate sufficient operating cash flow due to industry headwinds. This may force Carvana to tap into capital markets, potentially diluting the ownership of existing shareholders.

Is Carvana Stock a Buy, According to Analysts?

On June 10, JPMorgan (NYSE:JPM) analysts published a report on the auto sector highlighting the challenges faced by dealerships. However, analysts see marketplaces such as Carvana continuing to perform better at the expense of individual dealerships that would find it difficult to adjust to the dynamically changing industry conditions. Accordingly, JPMorgan analysts categorized Carvana as one of their top picks in the sector and projected continued upward revisions to adjusted EBITDA in the coming months.

Evercore ISI also shares a similar opinion. On June 6, analyst Michael Montani boosted his estimates for both retail units sold and EBITDA for Carvana in Q2 and identified the company’s strong digital presence as a key differentiator that would help robust revenue growth. With Carvana’s short interest hovering around 23%, the analyst believes a short squeeze rally is also on the cards, especially when Q2 earnings approach.

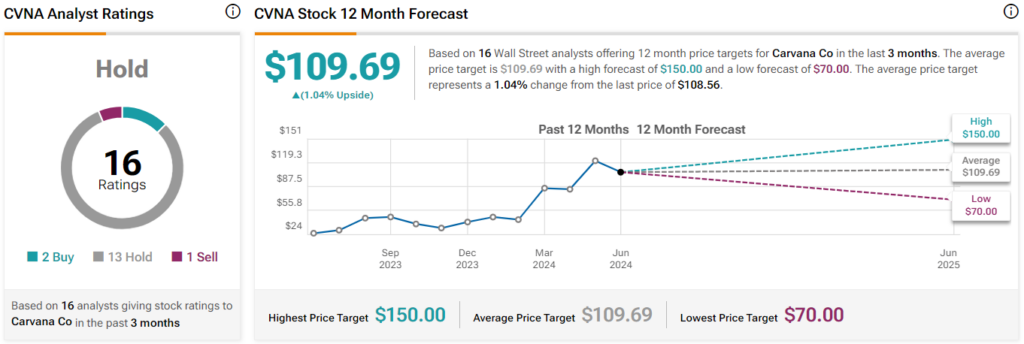

Overall, based on the ratings of 16 Wall Street analysts, CVNA stock comes in as a Hold. The average Carvana stock price target is $109.69, which implies just 1% upside potential.

The Takeaway: Carvana Is Expensive, But There’s a Lot to Like

Carvana’s unique business model deserves praise, as it has helped the company go against the grain and deliver industry-leading adjusted EBITDA margins and revenue growth. Wall Street analysts continue to see stellar growth ahead for Carvana, but the expensive valuation leaves little margin for error, which makes Carvana a very risky investment today.