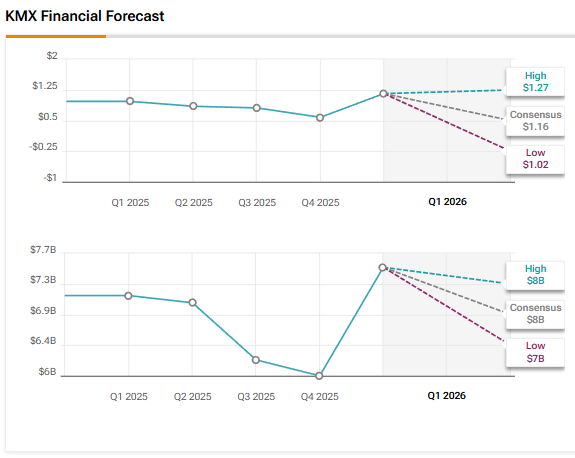

Used cars retailer CarMax (KMX) is scheduled to announce its results for the first quarter of Fiscal 2026 before the market opens on Friday, June 20. KMX stock is down 21.3% year-to-date due to concerns about the impact of tariffs, affordability concerns amid elevated interest rates, and weak consumer spending. Meanwhile, Wall Street expects CarMax to report EPS (earnings per share) of $1.16 in Q1 FY26, reflecting a 20% year-over-year growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue is expected to rise by about 5.5% to $7.5 billion compared to the prior-year quarter.

CarMax stock plunged in April, as the company missed analysts’ earnings expectations for the fiscal fourth quarter and removed the time frame for its financial goals, noting “the potential impact of broader macro factors.”

Top Analyst Weighs in on CarMax’s Q1 Earnings Expectations

Heading into Q1 results, William Blair analyst Sharon Zackfia reiterated a Buy rating on CarMax stock. The 5-star analyst expects the company to deliver roughly in-line first-quarter results, with used unit comparable sales up about 6.5%, marking the second straight quarter of accelerating comps and the brand’s strongest used unit comp since the third quarter of 2021.

Zackfia noted that her firm’s web data analysis indicates a 1% to 2% year-over-year decline in retail average selling price (ASP). The analyst expects Q1 revenue to grow about 3% (lower than the consensus estimate), including an estimated 1% increase in wholesale sales. She expects Q1 FY26 EPS of $1.22.

The analyst’s price target indicates a P/E multiple (based on 2025 earnings) of about 18x, given sales momentum and expectations for accelerating profitability in calendar year 2025.

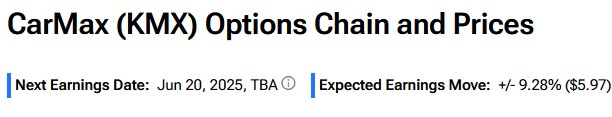

Options Traders Anticipate Notable Move on CarMax’s Q1 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 9.3% move in either direction in KMX stock in reaction to Q1 FY26 results.

Is CarMax a Good Stock to Buy?

Turning to Wall Street, CarMax stock scores a Moderate Buy consensus rating based on 10 Buys, two Holds, and two Sell recommendations. The average KMX stock price target of $82 indicates 27.5% upside potential from current levels.