Shares in global investment firm Carlyle (CG) edged higher today as it poured $1.3 billion of cash into U.S. insurance brokerage firm Trucordia.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Financially Flexible

The investment from Carlyle’s Global Credit platform will cut Trucordia’s debt and simplify its governance structure. It will also, Trucordia said, provide it long-term financial flexibility.

The deal, which is expected to close this month, values Trucordia, which offers commercial and personal insurance, life insurance, and employee benefits solutions, at over $5.7 billion.

“This investment and partnership with Carlyle will meaningfully strengthen Trucordia’s long-term financial and ownership structure and accelerate our transformational growth strategy,” said Felix Morgan, CEO of Trucordia.

Carlyle said it believes Trucordia is well placed to capitalize on long-term growth opportunities in the insurance distribution sector.

The U.S. insurance distribution market was valued at $210.37 billion in 2023 and is expected to reach $337.26 billion by 2029. It is being boosted by the rising use of technology and analytics to align products and pricing with customer needs.

Tech Drive

Indeed, the U.S. insurance distribution technology market in 2023 was valued at $20.44 billion. The market is projected to reach $50.70 billion by 2029.

Carlyle’s stock is down around 10% this year as uncertainty over the U.S. and global economy puts the squeeze on investment confidence.

However, its stock is up 0.5% over the last three months as some of that uncertainty eases.

In its recent first quarter results, the group said it had $84 billion in dry powder, which positioned it well to grasp suitable investment opportunities.

Is CG a Good Stock to Buy Now?

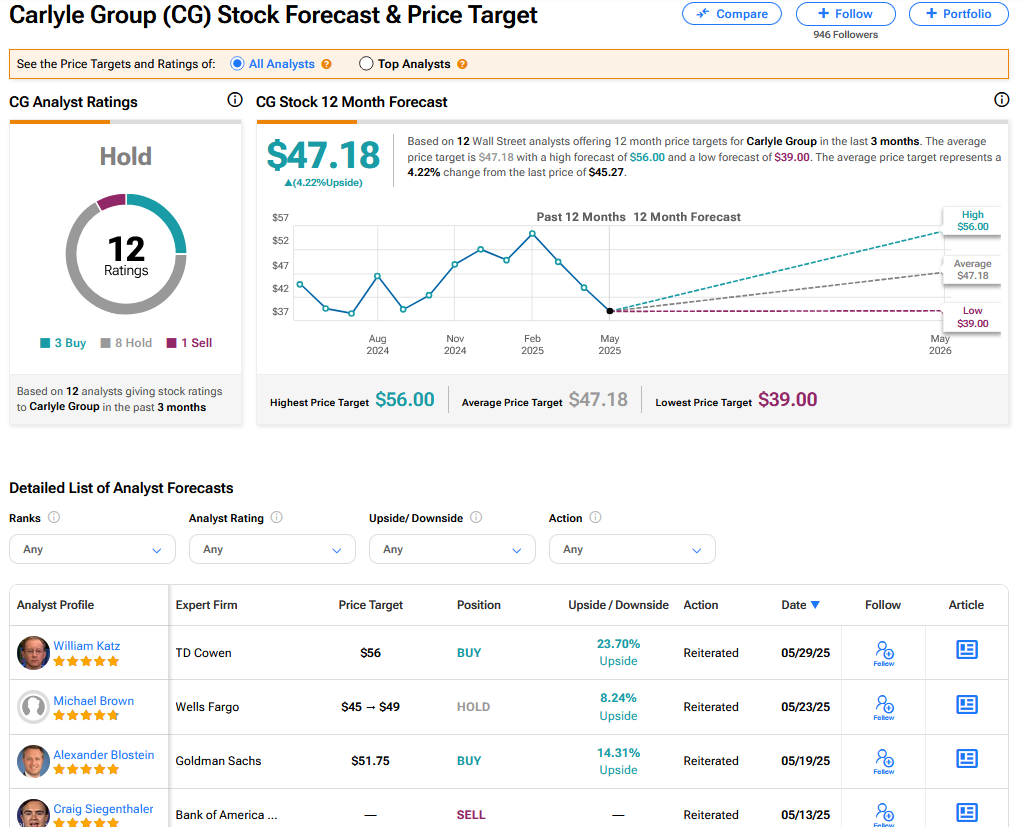

On TipRanks, CG has a Hold consensus based on 3 Buy, 8 Hold and 1 Sell rating. Its highest price target is $56. CG stock’s consensus price target is $47.18 implying an 4.22% upside.