After almost 10 years of its establishment, Carbon is one for the biggest companies of 3D printing in the world. Philip DeSimone, the co-founder, sees the firm’s main problem as production costs. Meanwhile, the factory orders have fallen, so it seems that Carbon may have even more problems.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

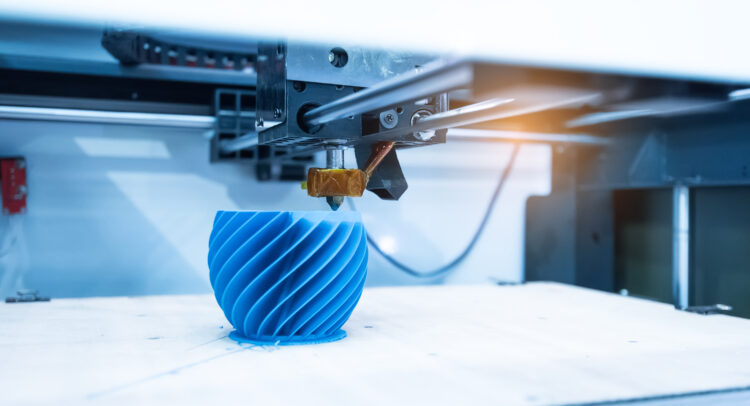

How Does Carbon’s Production Work?

The main purpose of the company is to provide customized end-use parts. Recently, DeSimone has announced that Carbon produces more than one million of them per week. One of the most successful cases of Carbon’s products is with adidas AG (ADDYY) and Ford Motor Company (F). The partnership with the Germans was for the Futurecraft 4D in 2021. On the other hand, the Americans ordered some devices to improve their cars and engines.

$0.10 Can Become Thousands

At first, people may think the main cost of this private company is producing the machines they use, or even the ones they sell. However, DeSimone highlights that the rising cost of materials, such as the resin, is their biggest enemy. Having this in mind, if you look at it in a prototype optic, it may not become a big problem, but a $0.10 change can become thousands of dollars when you put it on an industrial scale.

Demand and Political Problems

Recently, the Richmond Fed Manufacturing Index has changed. The indicator was at -15 and rose to -7, indicating a slight improvement in manufacturing conditions, with activity still in contraction but clearly less negative than before. This suggests easing weakness in factory output and orders, reducing immediate downside risks for manufacturers. As a result, sentiment in the manufacturing sector may improve modestly, supporting industrial and cyclical firms in the near term.

In addition, U.S. factory orders fell 1.3% month-on-month after a prior increase. This movement is a clear weakening in manufacturing demand. This points to softer near-term industrial activity and reduced capital spending momentum. As a result, industrial and cyclical manufacturers may face pressure, while the data could modestly support expectations of a more cautious Fed stance.

How does It Affect Carbon?

All in all, these shifts are likely to affect the client demand and Carbon’s spending. A market with fewer orders often leads companies to delay projects. In this environment, budgets tend to tighten, and investment decisions also become more cautious. As a result, the 3D printer company may see a slower pace of new contracts.

Furthermore, new technologies will get more time to be developed. This might be a big change and should decrease the demand for machines and materials. Despite stabilization in manufacturing indicators, companies remain highly focused on cost efficiency. Automation and ROI are still top priorities. This dynamic increases pressure on Carbon to demonstrate that its technology delivers economic value in a more selective and cost-conscious market.