Shares of Capri Holdings (CPRI) plunged 45%, while Tapestry (TPR) stock jumped over 14% in Thursday’s after-hours trading after a federal judge blocked their $8.5 billion merger. U.S. District Judge Jennifer Rochon ruled that Tapestry’s acquisition of Capri would result in anticompetitive pricing pressure in the affordable luxury handbag market.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Capri is the owner of several renowned brands, including Versace, Jimmy Choo, and Michael Kors, while Tapestry owns Coach, Kate Spade handbags, and Stuart Weitzman. Last year, the two companies entered into a deal allowing Tapestry to acquire Coach for $57 per share in cash. However, the FTC (Federal Trade Commission) vowed to block the deal and asked for an injunction to stop the merger in April this year.

Further Details of the Ruling

The ruling follows a rigorous eight-day trial in New York where the FTC argued that the combination of two leading luxury handbag makers would hurt consumers and stifle competition. Meanwhile, Tapestry contended that the combined power of the two was needed to fight the intense competition and win back market share from European bigwigs such as Gucci.

The judge’s ruling in favor of the FTC marks a big win for FTC Chair Lina Khan, who has been very aggressive in freezing monopolistic deals in all sectors. The FTC will still go ahead with its proceedings and the parties will have a chance to put forth their arguments. Interestingly, regulators from Japan and the European Union had approved the merger earlier this year.

Tapestry and Capri Vow to Appeal the Ruling

Disappointed by the district court’s preliminary injunction ruling yesterday, Tapestry issued a statement saying that the ruling was “incorrect on the law and the facts.” The company reiterated the highly competitive market and dynamic nature of the industry in which both Tapestry and Capri operate.

Tapestry highlighted the intense competition from both lower-priced and higher-priced products of rivals. The company also pointed out the anti-monopolistic and pro-consumer nature of the deal and announced its intent to appeal the court’s decision.

Following the statement, Capri announced that consistent with the merger agreement, it will join Tapestry’s appeal to the U.S. Court of Appeals.

Is Tapestry a Good Stock to Buy?

Wall Street remains divided on Tapestry amid the pending merger. On TipRanks, TPR stock has a Moderate Buy consensus rating based on eight Buys and three Hold ratings. Also, the average Tapestry price target of $48.45 implies a nearly 9% upside potential from current levels. Year-to-date, TPR shares have gained 23.7%.

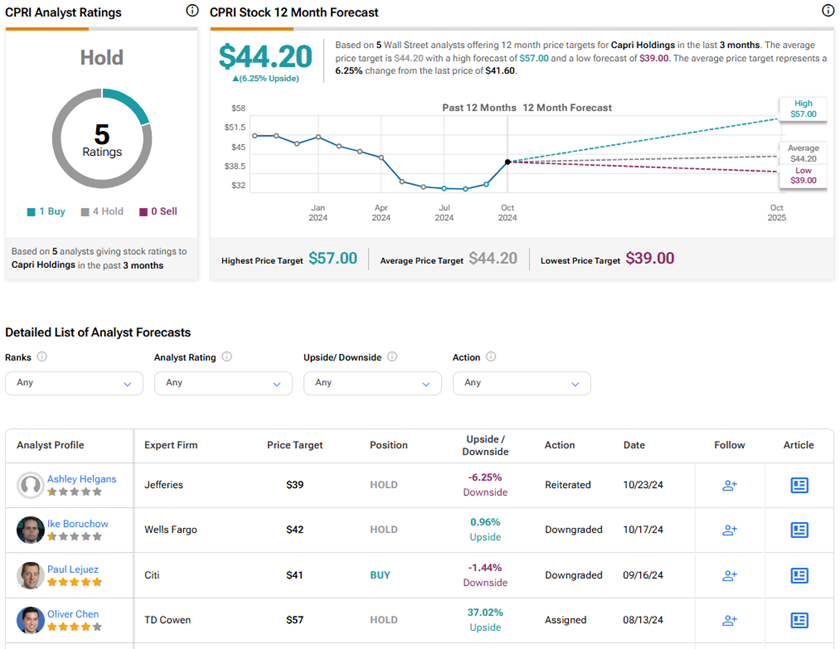

Is Capri Holdings a Good Stock to Buy?

Analysts prefer remaining on the sidelines on Capri Holdings until the merger dust settles. On TipRanks, CPRI stock has a Hold consensus rating based on one Buy versus four Hold ratings. The average Capri Holdings price target of $44.20 implies 6.3% upside potential from current levels.