Canadian Western Bank (TSE:CWB) soared today, gaining 11.45%, after reporting Q3-2023 earnings results that beat analysts’ expectations. The bank’s adjusted earnings per share (EPS) reached C$0.88, beating the C$0.82 consensus forecast and growing by 19% year-over-year. Revenue also beat estimates, coming in at C$283.5 million vs. the C$276.8 million consensus. Further, National Bank of Canada (TSE:NA) raised its price target on CWB stock from $28 to $33, giving the stock extra strength today.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, CWB’s earnings fared much better than those of Canada’s big banks, including Royal Bank of Canada’s (TSE:RY) (NYSE:RY) adjusted EPS, which saw an 11% increase. For instance, the adjusted EPS figures for Bank of Montreal (TSE:BMO) (NYSE:BMO) and Bank of Nova Scotia (TSE:BNS) (NYSE:BNS) declined by 10% and 17.6%, respectively, year-over-year. Therefore, CWB performed exceptionally well there, as higher net interest margins made up for the increase in provisions for credit losses.

Speaking of net interest margins, that’s part of the reason why National Bank raised its price target on the stock, as CWB experienced an 11-basis-point net interest margin expansion and capital stability. Also, National Bank highlighted that CWB’s branch-raised deposits grew 3% compared to Q2 2023.

Next, CWB reported an adjusted return on equity (ROE) of 10%, up 110 basis points on a year-over-year basis, and is targeting an adjusted ROE of 10% to 11% for the year as a result of expense management and revenue growth.

Is CWB a Good Stock to Buy?

According to analysts, CWB stock comes in as a Moderate Buy based on two Buys and one Hold assigned in the past three months. However, the average CWB stock price target of C$29.59 implies just 1% upside potential.

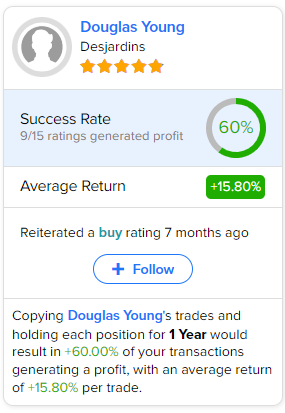

If you’re wondering which analyst you should follow if you want to buy and sell BMO stock, the most accurate analyst covering the stock (on a one-year timeframe) is Douglas Young of Desjardins, with an average return of 15.8% per rating and a 60% success rate. Click on the image below to learn more.