Canadian Pacific (CP) reported its second-quarter results on July 28 after market close. The transcontinental railway’s profit and revenue rose thanks to a robust base demand environment.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue came in at C$2.05 billion in the second quarter of 2021, an increase of 15% from C$1.79 billion last year. Revenue missed analysts estimates by C$10 million.

Meanwhile, diluted EPS was C$1.86 in Q2 2021, an increase of 100% from C$0.93 in Q2 2020.

On an adjusted basis, CP earned C$1.03 per share for the quarter, up 27% from C$0.81 last year, and beat analysts’ estimates by C$0.02.

The operating ratio (including Kansas City Southern acquisition-related costs) improved to 60.1% in the second quarter, from 57.0% last year.

Canadian Pacific’s President and CEO Keith Creel said, “Our industry-leading team of railroaders delivered another record quarter. I am particularly proud of our all-time record safety performance made possible by the collective efforts of the over 12,000-strong CP family. The robust base demand environment coupled with our unique growth opportunities has CP extremely well positioned as we head into the second half of the year.”

Creel added, “We remain confident in our full-year guidance of double-digit adjusted diluted EPS growth relative to 2020’s adjusted diluted EPS of $3.53. Our ability to deliver sustainable, profitable growth has never been stronger.” (See Canadian Pacific stock charts on TipRanks)

On July 16, Raymond James analyst Steve Hansen maintained a Buy rating on CP while lowering its price target to C$98.00 (from C$100.00). This implies 8.5% upside potential.

Hansen wrote in a pre-earnings note, “Despite near term headwinds – forex, fuel pricing, network fire disruptions – we continue to view both Canadian National and Canadian Pacific as well situated to further benefit from ongoing recovery tailwinds.”

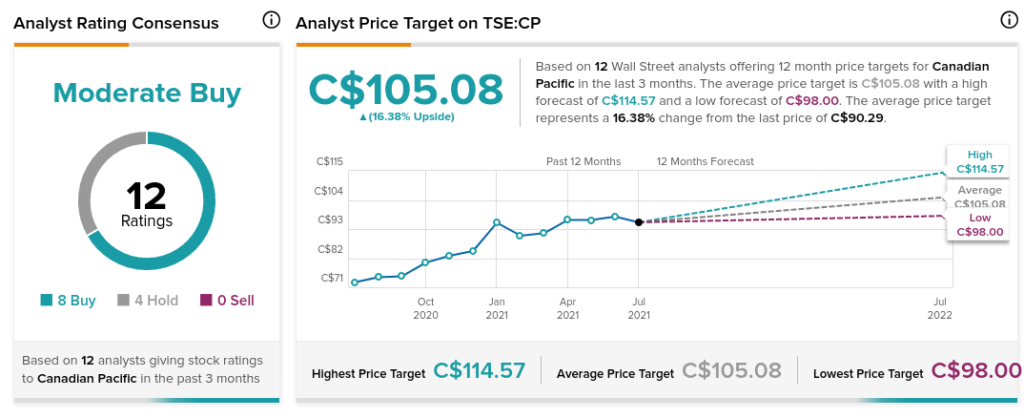

Overall, consensus on the Street is that CP is a Moderate Buy based on 8 Buys and 4 Holds. The average Canadian Pacific price target of C$105.08 implies upside potential of about 16.4% to current levels.

Related News:

Copper Mountain Shares Pop 7% After Strong Q2

Newmont’s Adjusted Profit Rises 12.8% in Q2, Beats Estimates

CN Rail Revenue Rises 12% in Q2, Profit Nearly Doubles