Canadian National Railway (TSE:CNR) (NYSE:CNR) reported its Q2 earnings results earlier today, which missed both revenue and EPS estimates. Also, the firm has been forced to hit the brakes on its earnings outlook for 2023, facing a rocky second quarter with falling profits and revenues. Once eyeing mid-single-digit growth, the rail giant now estimates a static or slightly negative adjusted earnings growth for the year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CNR’s revenue slipped to C$4.057 billion in Q2 (estimates called for C$4.133 billion), a 7% dip from the same period last year. Meanwhile, earnings per share came in at C$1.76 (vs. the consensus estimate of C$1.79), falling by 9% year-over-year. Operating income also took a hit, skidding by 10% to C$1.6 billion. Nonetheless, there was a surge in free cash flow, which increased by 10% to C$1,100 million this quarter.

Despite the bumpy ride, CN remains hopeful about the journey ahead, sticking to its target of a 10% to 15% annual growth rate in diluted EPS from 2024 to 2026.

Is CNR Stock a Buy, According to Analysts?

According to analysts, Canadian National Rail stock comes in as a Moderate Buy. That’s based on five Buys and nine Holds assigned in the past three months. The average CNR stock price target of C$171.66 implies 9.77% upside potential.

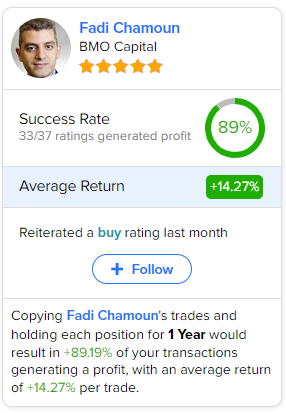

If you’re wondering which analyst you should follow if you want to buy and sell CNR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Fadi Chamoun of BMO Capital, with an average return of 14.27% per rating and an 89% success rate. Click the image below to learn more.