The Canadian dollar has risen sharply in recent days as the U.S. currency weakens due to uncertainty caused by American President Donald Trump’s trade tariffs.

The Canadian dollar is trading above $0.71 U.S. for the first time in five months as the American dollar slides lower. The greenback, as the U.S. dollar is known, has slumped even after President Trump walked back many of his tariff measures on April 9.

The Canadian dollar rose more than 1% on April 10 after the Trump administration clarified that its import tariffs on Chinese goods stand at 145%. Concerns about an escalating trade war between the U.S. and China has currency traders moving into safe havens such as the Japanese yen, Canadian dollar, and Swiss franc.

Flight to Safety

The U.S. dollar fell 1.34% on April 10 on news that the country is ratcheting up its trade war with China even as it de-escalates with other countries around the world. The U.S. dollar index that tracks the greenback against a basket of other world currencies is down 7.7% since January of this year.

Many economists expect the U.S. dollar to weaken further as the U.S. economy looks increasingly vulnerable to a recession. Expectations are also rising for more interest rate cuts from the U.S. Federal Reserve this year as America’s economy slows, which would further weaken the greenback, say analysts.

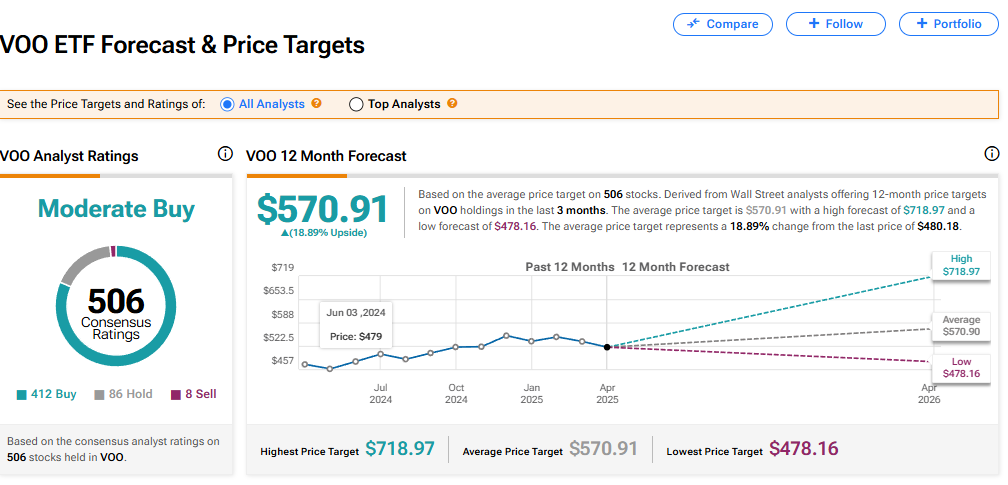

Is the Vanguard S&P 500 ETF a Buy?

The Vanguard S&P 500 ETF (VOO), which tracks the movements of the benchmark U.S. stock index, has a consensus Moderate Buy rating among 506 Wall Street analysts. That rating is based on 412 Buy, 86 Hold, and eight Sell recommendations made in the last three months. The average VOO price target of $570.91 implies 18.89% upside from current levels.