While there are a variety of Canadian stocks out there—we’ve seen everything from toy companies to firms that make robot arms for space travel—we also know that commodities, in one form or another, are a big part of Canadian business. So, with metal prices on the rise, it’s little surprise that Canada’s TSX exchange has been enjoying a lot of success. That’s demonstrated nicely with the iShares Core S&P / TSX Capped Composite Index exchange traded fund (TSE:XIC), down fractionally in Wednesday morning’s trading but up substantially over the last year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A combination of factors is giving the TSX a rise, reports noted. The leading factor is the rise of metal prices, which is a big portion of the TSX’s overall composition. Throw in declining inflation figures that will make rate cuts likely—the U.S. is still waiting for its first such cut of 2024—and that means lower borrowing costs and a better overall economic outlook.

That combination was enough to give the TSX a rise of over 7% since January, and it recently broke a record high from March 2022. This is more of a help to bank stocks than anything else, though, as it would take a boost in global economic activity to help the resource market much. But with Canada’s major banks increasing their bad loan reserves ahead of earnings reports, that could mean some further pressure on the banks.

Recent Pressures

However, even as the TSX has seen a record run-up in the last several months, the last several hours have been a bit of a different story. We know that the TSX’s run has been bolstered by metals prices, so recent easing in those prices has prompted a bit of a decline. They’re still up overall and significantly, but an exchange so closely wedded to commodities will inevitably see fluctuation depending on commodity prices, which is about what we’re seeing right now.

Is XIC a Good Buy?

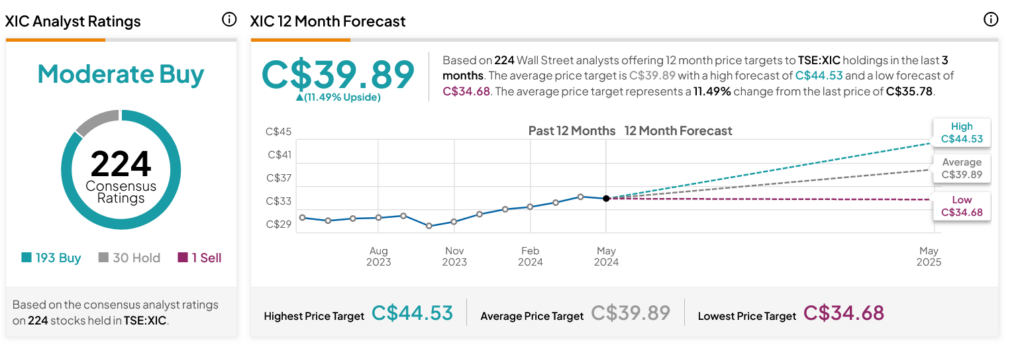

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XIC stock based on 193 Buys, 30 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 15.15% rally in its share price over the past year, the average XIC price target of C$39.89 per share implies 11.49% upside potential.