The stock of Canadian e-commerce company Shopify (SHOP) has been downgraded due to its valuation.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wolfe Research has lowered its rating on SHOP stock to a Hold-equivalent peer perform from a Buy-equivalent rating previously. In issuing the downgrade, Wolfe Research said that shares of Shopify look “fully valued” after a strong run over the past two years.

The independent sell-side research firm said investors should be aware that there is likely limited room for further upside in SHOP stock after it gained 56% in the past 12 months. Wolfe Research said that expectations around growth are already high, while margins are unlikely to expand as quickly as revenue.

AI Impacts for Shopify

While management at Shopify has been touting the company’s adoption of new artificial intelligence (AI) products and their benefits for customers, analysts at Wolfe Research say that the long-term promise of AI-driven or agentic commerce appears to already be priced into SHOP stock.

Wolfe adds that it doesn’t expect a material impact from AI on Shopify’s near-term estimates and believes longer term benefits are already captured in the stock’s valuation. The Wall Street firm concludes that Shopify remains a high-quality business with a strong competitive position. But investors should have modest expectations after a bull run in SHOP stock.

Is SHOP Stock a Buy?

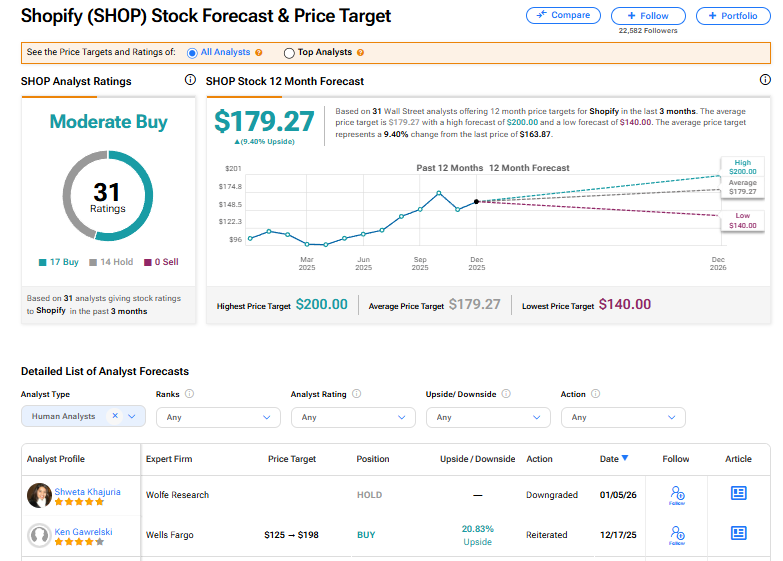

The stock of Shopify has a consensus Moderate Buy rating among 31 Wall Street analysts. That rating is based on 17 Buy and 14 Hold recommendations issued in the last three months. The average SHOP price target of $179.27 implies 9.40% upside from current levels.