Analysts at U.S. investment bank Goldman Sachs (GS) have downgraded Canadian luxury parka maker Canada Goose Holdings’ (TSE:GOOS) stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Goldman Sachs lowered its rating on Canada Goose stock to Sell from Hold previously, and cut its price target on the shares to $9 from $11.50. The downgrade prompted investors to scatter like geese, and GOOS stock fell 7% in trading on October 21.

Goldman Sachs cited a “…less attractive risk / reward” scenario as the reason for its downgrade. There is currently a slowdown in the worldwide luxury market, and Canada Goose is well known for its luxurious outerwear. There are also concerns that global warming is slowing demand for winter parkas.

GOOS stock is down nearly 15% in the past year.

Not Without a Fight

Canada Goose is taking steps to improve its sales and share price. The company is bringing in designer Haider Ackerman to put together a 60-piece collection for Canada Goose that may serve to spark new interest in the company’s outerwear.

Canada Goose’s next quarterly financial results are to be issued on November 7. It may need some fresh ideas in the pipeline to announce alongside its earnings to calm skittish investors.

Is Canada Goose Stock a Buy?

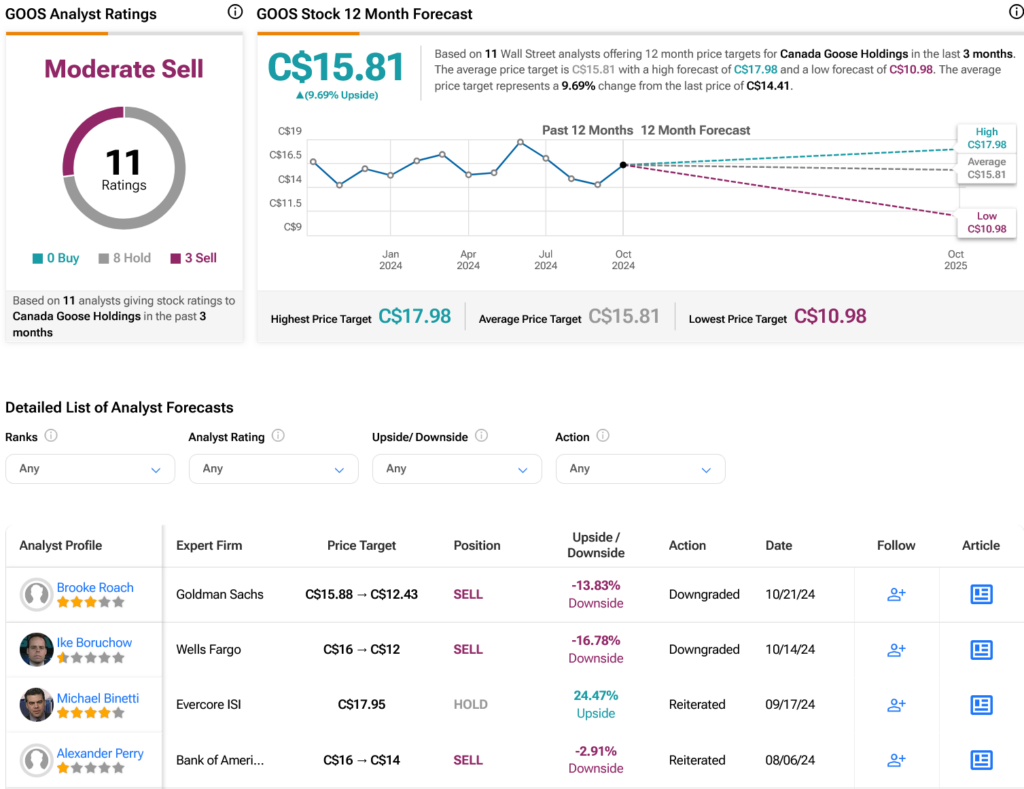

Turning to Wall Street, analysts have a Moderate Sell consensus rating on TSE:GOOS stock based on eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 13.39% loss in its share price over the past year, the average TSE:GOOS price target of C$15.81 per share implies 9.69% upside potential.