Canada Goose Holdings Inc. (GOOS) revenue more than doubled in its first quarter from a year ago, driven by strong growth in digital business.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, it posted a wider loss. This might explain why the stock price fell by 14% in early trading Wednesday. Based in Toronto, Canada Goose is one of the world’s largest extreme weather outerwear retailers.

Revenue for Q1 2022 came in at C$56.3 million, an increase of 116% from C$26.1 million. Global ecommerce revenue rose 80.8%. (See Canada Goose Holdings Inc stock charts on TipRanks)

Both direct-to-consumer (DTC) sales and wholesale revenue increased in the quarter ended June 27. DTC revenue rose 183% to C$29.4 million, driven by ecommerce growth, a lower level of COVID-19-related disruption, and more store openings, despite persistent headwinds from in-store traffic.

Wholesale revenues increased 196.6% to C$25.8 million thanks to a higher volume of shipments to wholesale and international distribution partners.

Meanwhile, net loss amounted to C$56.7 million (-C$0.51 per diluted share), compared to C$50.1 million (-C$0.46 per diluted share) in the first quarter of 2021.

On an adjusted basis, Canada Goose lost C$0.45 per diluted share in the quarter, compared to a loss of C$0.35 per diluted share a year ago. Analysts on average had expected an adjusted loss of C$0.54 per share and C$49.7 million in revenue.

Canada Goose president and CEO Dani Reiss said, “Canada Goose is off to a great start in the first quarter. Our digital business continued at a rapid pace of growth globally, alongside improving retail trends. With strong momentum in a less disrupted operating environment, and an exciting product pipeline – including our growing apparel business and footwear launch later this fall – we are well positioned for fiscal 2022.”

The company maintained its outlook for FY 2022, one that was originally issued on May 13, 2021. For the second quarter, low double-digit wholesale revenue growth and DTC revenue at about one-and-a-half times last year’s level are forecasted.

On August 10, Evercore ISI analyst Omar Saad reiterated a Buy rating on GOOS with a price target of $60.00 (C$75.14). This implies 57.9% upside potential.

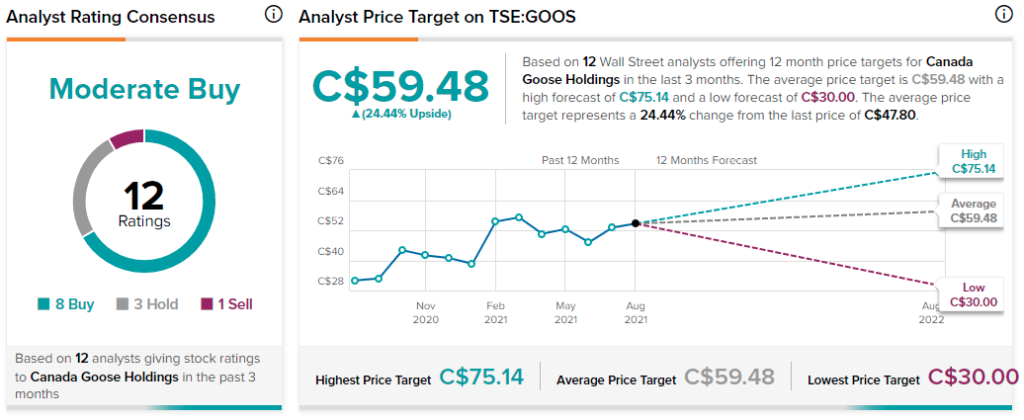

The rest of the Street is cautiously optimistic on GOOS with a Moderate Buy consensus rating based on eight Buys, three Holds, and one Sell. The average Canada Goose price target of C$59.48 implies upside potential of 24.4% to current levels.

Related News:

Sleep Country’s Q2 Revenues Rise 67%; Shares Gain 16%

Aritzia Swings into Profit in Q1, Sales Up 122%

Roots E-Commerce Sales Rise 50% in Q1; Shares Pop More Than 7%