Despite leading most of the crypto market in transactions per second (TPS), Solana’s (SOL-USD) performance during a recent scandal involving a $2 million Pump.fun exploit may impact investor confidence.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Topping the Charts

Recent data from CoinGecko shows Solana flexing hard with its transactions per second (TPS). Solana tops the charts at a blazing 1,053 TPS, leaving competitors like Polygon (MATIC-USD) and its measly 190 TPS in the dust. Ethereum (ETH-USD)? Please, it’s crawling with just 22 TPS. Solana Explorer even reported a peak TPS of 2,303. That’s right, Solana is moving faster than a caffeine-fueled cheetah.

This speed has translated into more daily active addresses, which spiked to over 2.4 million in mid-March. However, despite this surge in active users, the daily transaction count has been pretty steady since February, with a brief bump on April 11.

But hold on, it’s not all rainbows and unicorns. SOL’s fees tanked after a spike in mid-March, dragging down the blockchain’s revenue. And let’s not forget, back in March, Solana’s transactions had a failure rate of 70% for weeks.

It’s kind of like bragging about your new machine gun, but it’s a vintage Chauchat, arguably the worst machine gun ever fielded. Yes, it can spit out 240 rounds a minute, but did you hit anything?

Still, Solana’s DeFi game is on point, with its total value locked (TVL) continuing to climb.

The Pump.fun Exploit Drama

But just when you thought Solana was cruising, along comes the Pump.fun exploit to throw a wrench in the works. Jarett Reginald Dunn, aka Stacc on Twitter, admitted to pulling off a $2 million exploit on Pump.fun. He was reportedly arrested near the Pump.fun WeWork in Covent Garden, London, on May 17.

Dunn claimed he was charged with “theft from employer for $2 million with conspiracy of another $80 million.” But here’s the kicker: the Metropolitan Police have no record of these charges. Dunn, a former Pump.fun employee, seemed pretty chill about his potential prison time, flaunting his disdain for the protocol on X.

For the uninitiated, Pump.fun lets users launch Solana tokens quickly and cheaply. Post-exploit, wallet provider Phantom blocked the site, and trading paused. Dunn was held for 20 hours at Islington station before being released on bail. He’s set to return for a Criminal Investigation Department interview on August 16 and has been ordered to steer clear of anyone or any place linked to Pump.fun.

Will Solana soar to new heights, or will the scandal drag it down? Only time will tell, but one thing’s for sure: it’s never boring in the world of crypto.

Is Solana a Buy?

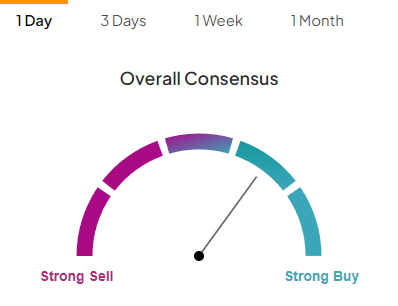

According to TipRanks’ Summary of Technical Indicators, Solana is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.