Salesforce (NYSE:CRM) went public two decades ago and has returned nearly 7,000% to shareholders since its IPO (initial public offering). However, while major equity indices are trading near all-time highs, Salesforce stock is down ~18% from record levels (see below), allowing investors to buy a quality stock at a discount. I believe Salesforce can stage a rebound in the second half of 2024 and outpace other mega-cap stocks. I am bullish on Salesforce due to its reasonable valuation and steady growth potential.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

An Overview of Salesforce

Salesforce is the largest customer relationship management company in the world, valued at $248 billion by market cap. Its services enable enterprises to store data, monitor leads, forecast opportunities, and gain insights through analytics and artificial intelligence.

Is Slowing Revenue Growth a Concern?

A major reason for Salesforce’s underperformance can be tied to its slowing revenue growth. In fiscal 2022 (ended in January), Salesforce increased sales by 24.66% to $26.49 billion. Comparatively, in Fiscal Q1 of 2025, its top-line growth stood at 11%.

It suggests that investors should no longer consider Salesforce as a high-flying growth stock. Instead, it is now a fairly mature company and is moving further towards market saturation. However, this transition means that Salesforce can now focus on expanding its profit margins to benefit from economies of scale.

In Fiscal Q1, Salesforce reported revenue of $9.13 billion and adjusted earnings per share of $2.44. Comparatively, analysts forecast sales at $9.17 billion with earnings of $2.38 per share. Salesforce’s revenue miss drove CRM stock lower by 20% in a single trading session after the company stated it expects budget scrutiny and longer-than-usual deal cycles to weigh on enterprise spending in the near term.

Salesforce might not be a dynamic disruptor that continues to beat the broader markets by a wide margin. However, its double-digit growth rates still mean it is growing faster than the economy and the majority of the companies part of the S&P 500 Index (SPX).

Focusing on Profitability

As its sales growth normalizes, Salesforce is focused on improving profit margins. Similar to other companies across sectors, Salesforce has exercised cost-cutting measures to improve cash flows and earnings.

In the last 12 months, Salesforce’s operating margin has improved from 13.61% to 18.8%. An improving margin base suggests that Salesforce’s profits are growing faster than sales.

However, a better metric for profitability is free cash flow, as it adjusts for non-cash expenses and capital expenditures. In the last 12 months, Salesforce has reported unlevered free cash flow of $12.59 billion, indicating a margin of 35.2%. Salesforce ended Fiscal 2024 with free cash flow per share of $9.75, up from $4.45 per share in Fiscal 2020, providing it with the flexibility to invest in organic growth and acquisitions.

Is Salesforce an AI Play?

The AI megatrend has driven shares of several big tech companies higher in the past 18 months. As stated above, Salesforce expects customer demand to remain soft in Fiscal 2025. However, this weakness could be offset by its AI capabilities. To gain traction in this disruptive segment, Salesforce has invested heavily in improving its cloud computing services, such as Data Cloud.

Companies use Data Cloud to integrate all business data into a specific repository. Salesforce claimed that more than 1,000 customers adopted the Data Cloud for the second consecutive quarter in Q1.

According to Salesforce, Data Cloud will be a key revenue driver, going forward. The company has successfully leveraged its access to massive data sets, as it has access to a comprehensive CRM platform, offering it a competitive advantage.

Is Salesforce Stock Undervalued?

One easy way to value a company is by looking at its price-to-earnings multiple. Keeping all things equal, a lower price-to-earnings ratio is favorable, as it suggests that the stock is undervalued compared to its peers.

Analysts tracking Salesforce expect adjusted earnings to improve from $8.22 per share in Fiscal 2024 to $9.90 in Fiscal 2025. On a non-GAAP basis, CRM stock is priced at 25.9x forward earnings, which is higher than the sector median of 24.4x.

However, Salesforce’s earnings growth is forecast at 28%, which is much higher than the sector median of 7.5%. Given its peer-beating earnings growth estimates, CRM stock is not too expensive at its current price.

What Is the Target Price for CRM Stock?

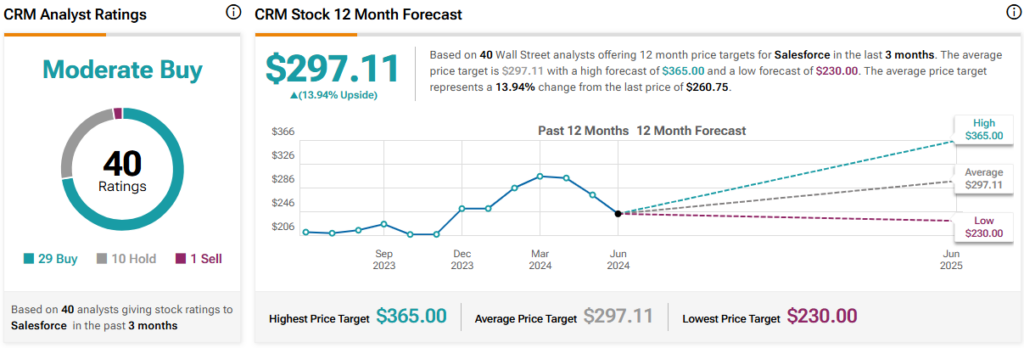

Out of the 40 analyst ratings given to CRM stock, 29 are Buys, 10 are Holds, and one is a Sell, indicating a Moderate Buy consensus rating. The average CRM stock price target $297.11, indicating upside potential of 13.9% from current levels.

The Takeaway

It’s evident that Salesforce enjoys a competitive moat and is maturing at a steady pace. Moreover, the company’s reasonable valuation suggests that it is poised to gain momentum, especially if customer demand improves.

Salesforce has strong fundamentals to support its valuation, making it an enticing long-term investment choice in June 2024.