Streaming platform and device provider Roku (NASDAQ:ROKU) was among the hottest stocks during the pandemic. However, similar to other tech stocks, Roku fell off a cliff amid the bear market of 2022 and currently trades 88% below all-time highs, valuing the company at $8.2 billion. While I don’t think ROKU stock can reclaim its all-time high this year, it still looks like a worthy investment at the moment, given an improved macro environment. I am bullish on Roku due to the global shift towards online streaming, its improving profit margins, and its cheap valuation.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

An Overview of Roku

Roku has two primary business segments: Platform and Devices. The Platform business includes digital ads and related services, as well as content distribution services such as subscription and transaction revenue shares, media spending, and the sale of branded buttons on remote controls.

The Devices business sells streaming players, audio products, smart home products, and accessories online and via other distribution channels.

Roku’s streaming platform continues to grow its customer base and engagement. At the end of Q1 2024, its platform had attracted 81.6 million streaming households, an increase of 14% year-over-year. Moreover, these households watched 30.8 billion hours of content on Roku’s operating system in the first three months of 2024, up 23% year-over-year.

Roku Is Part of an Expanding Market

The cord-cutting phenomenon and the worldwide shift towards streaming are among the biggest tech trends in the past decade. Customers and households are “cutting the cable cord” and have subscribed to streaming platforms due to a wide range of content and viewing flexibility.

In fact, roughly 50% of U.S. households have cut the cord, and the majority spend over 50% of their viewing time on streaming channels. Comparatively, just 29% of TV ad budgets are targeted toward these viewers, according to a 2023 report from eMarketer. This gap is likely to close in the next 10 years, positioning Roku for steady growth.

Roku’s unique combination of platform services and ad capabilities should help it benefit from the growth in video streaming and online ads. For example, Roku already aggregates multiple streaming services while providing marketers with the tools to target connected TV (CTV) audiences via personalized ads.

Roku’s Profit Margins and Cash Flow

In Q1 of 2024, Roku grew its sales by 19% year-over-year to $881.5 million. However, its gross profits grew by just 15% to $388.3 million, indicating a margin of 44.1%, down from 45.6% in the same period last year. The key reason for Roku’s narrowing gross margins is its Devices business, where the margin was negative. It suggests that Roku’s hardware devices, such as streaming products, cost more to make compared to their selling price.

There is a good chance that Roku is selling its hardware devices at a loss to maintain its market share, where it competes with Google (NASDAQ:GOOGL) (NASDAQ:GOOG), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN).

In the last three years, Roku’s sales grew by 53%, but its operating expenses growth was much higher at 83%. However, in the last 12 months, Roku has lowered operating expenses to $460.3 million in Q1, down from $550 million in the same period last year.

This reduction in spending meant Roku reported free cash flow of $426.8 million in the last 12 months. In the year-ago period, its cash outflow stood at $448 million. A company’s cash flow is a much better measure of profitability than net income, as it excludes noncash items. Basically, free cash flow shows us the actual outflow or inflow of cash in a business.

A positive free cash flow figure suggests the company has enough resources to reinvest in growth and acquisitions, as well as strengthen its balance sheet.

Is Roku Stock Undervalued?

Roku’s drawdown in share prices makes it attractive for contrarian investors. As the company still reports a net loss, it’s difficult to value the stock on the basis of traditional ratios such as price to earnings. However, Roku stock trades at 19.2 times trailing cash flows, which I believe is not too expensive, especially if it can continue to grow this metric aggressively. Comparatively, Netflix (NASDAQ:NFLX), the largest streaming platform in the world, is priced at 40x trailing cash flows.

Is ROKU Stock a Buy, According to Analysts?

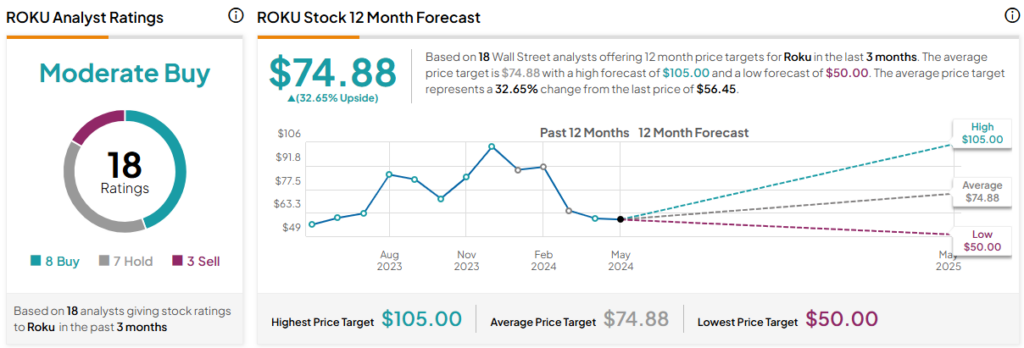

Out of the 18 analyst ratings given to Roku stock, eight are Buys, seven are Holds, and three are Sells, indicating a Moderate Buy consensus rating. The average ROKU stock price target is $74.88, indicating upside potential of 32.65% from current levels.

The Takeaway

It’s highly unlikely for Roku to touch all-time highs this year. However, the tech stock is positioned to deliver outsized gains to shareholders in the next 12 months, especially if it can continue to expand its free cash flow and narrow its losses, going forward.