Well, the week is over and GTC 2024 is a wrap. The festival of tech hosted by Nvidia (NASDAQ:NVDA) that began with a keynote address by CEO Jensen Huang that left investors mostly impressed, ended up lifting Nvidia stock more than 7% by the week-end.

And if its stock price gains you want, UBS’s Timothy Arcuri, a 5-star analyst rated in the top 1% of the Street’s stock pros, says there’s more in-store.

“Having attended several sessions at GTC,” wrote Arcuri, he came away impressed with the launch of Nvidia’s newest “Blackwell” artificial intelligence chip, and convinced that “NVDA sits on the cusp of an entirely new wave of demand from global enterprises and sovereigns.”

Of particular note is Arcuri’s observation that Nvidia won’t just be reacting to organic demand from these customers, and producing AI chips to satisfy that demand. Rather, as the analyst puts it, Nvidia will “create its own market” by developing (and selling, natch – at the princely sum of $4,500 per GPU using the software, per year) its own software including “new pre-packaged and pre-trained modular AI models” for its customers to use. And because these models will require fast chips to run them, Nvidia will then also sell them those chips.

Simply put, Nvidia will first create the demand for its chips, and then sell the chips to satisfy the demand – which sounds like a nice work if you can get it.

What will this mean for Nvidia in dollars and cents? Well, consider that Nvidia ended 2023 with just under $61 billion in total revenue, and just under $30 billion in net profit from that revenue – a net profit margin of 49%. Looking out one year, Arcuri predicts that Nvidia will nearly double its revenues again to $112.5 billion this year, and earn $64.5 billion on those revenues – a staggering 57% net profit margin. Then the company will grow its revenues another 30% in 2025, to $146.9 billion, and earn $84.8 billion – a 58% margin.

If all that seems a bit too heady to believe, never fear. Arcuri isn’t predicting Nvidia stock will go to the moon, or not literally at least. Both growth and profit margins will begin to settle down a bit in outlying years. Looking way out to 2029 for example, the analyst is predicting only $183.7 billion in total sales, and a mere $100.4 billion in profits. That would make for a relatively modest 22% growth rate in that year, and a downright svelte profit margin of only… 55%.

If you’ll forgive the sarcasm.

But seriously, is any of this realistic? I admit, it sounds kind of fantastic, and probably would not be realistic at all… but for the fact that Nvidia has already proven to the world that it can grow faster than anyone believed possible, and generate profit margins much higher than anyone ever imagined. Given the company’s success so far, you can’t really rule out the possibility that Arcuri is right in saying he thinks Nvidia stock is worth $1,100 per share today, and deserves a Buy rating. (To watch Arcuri’s track record, click here)

Just one word of caution, though, might be appropriate: The growth and margins Arcuri is predicting are so attractive that they’re bound to attract competition from other companies wanting to horn in on Nvidia’s business. While Nvidia seems to have the AI world all to itself right now, a lot can change between now, and when we get a chance to evaluate how close Arcuri’s 2029 predictions were to accurate.

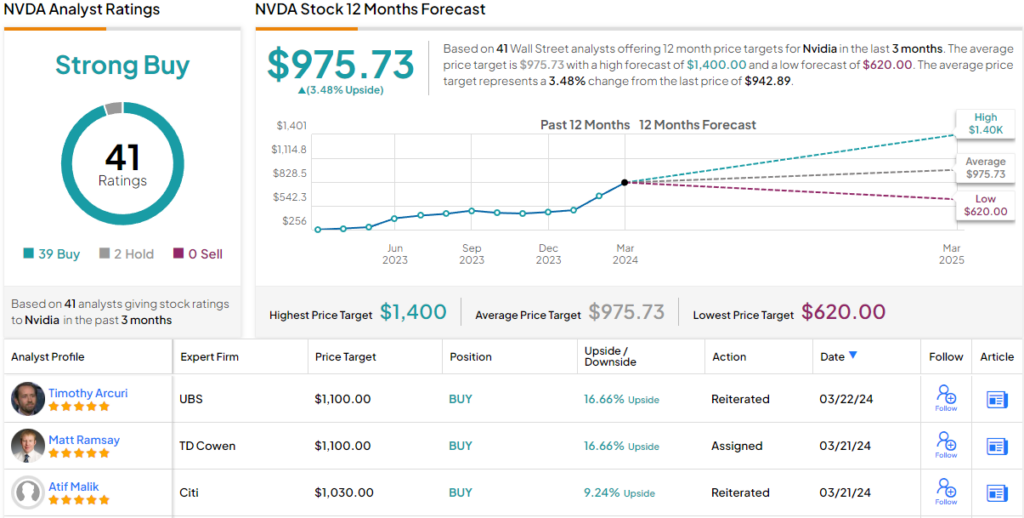

Overall, NVDA has received an impressive 41 analyst reviews recently. More impressive, 39 of those are to Buy, against just 2 Holds (i.e. Neutral). The stock is priced at $942.89 with an average target of $975.73, indicating potential for a modest 3.5% upside this year. It will be interesting to see if other analysts follow Arcuri’s lead and revise their price targets upward. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.