CoreWeave (NASDAQ:CRWV) stock has made quite a splash only a few months into its public journey. Despite some recent turbulence, CRWV has still surged 135% since its IPO at the end of March.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That turbulence set in after the AI cloud hosting firm’s Q2 2025 results, with shares tumbling more than a third. Revenues were a robust $1.21 billion, beating estimates by $131.4 million, but earnings of $-0.27 per share missed by $0.04. Adding to investor unease, interest expenses ballooned from $67 million in Q1 2024 to $267 million in the latest quarter.

Beyond the earnings miss and the surge in borrowing costs, the August lockup expiration opened the door for early investors to take profits, a factor that may have added to the recent selling pressure. With insiders and early backers free to offload shares, the overhang created a challenging backdrop for the stock just as Wall Street was digesting the weaker-than-expected bottom line.

Even so, not everyone sees the selloff as the end of the story. H.C. Wainwright’s Kevin Dede argues that the recent pullback could set the stage for long-term gains, noting, “We like the CoreWeave story as a leader in perhaps one of the most influential technology adoption cycles of our time.”

Backing his bullish stance, Dede points to management’s decision to raise FY 2025 revenue guidance to $5.25 billion, alongside his own FY 2026 forecast of $11.2 billion.

But numbers alone don’t capture the full picture. A potential ace-in-the-hole is CoreWeave’s close partnership with Nvidia, which Dede believes strengthens the company’s positioning “beyond software development.”

On that basis, the analyst believes the lower share price opens the door for investors to “enjoy healthy returns to previous stock levels.” Using his FY 2026 EBITDA estimate of $6.2 billion, CRWV trades at just 8.4x EV-to-EBITDA, well below the 15x to 20x range typically awarded to cloud and datacenter players.

Tying it all together, Dede sets a $180 price target – representing 91% upside – and says he is now “fully on the bullish side,” upgrading CRWV to a Buy. (To watch Kevin Dede’s track record, click here)

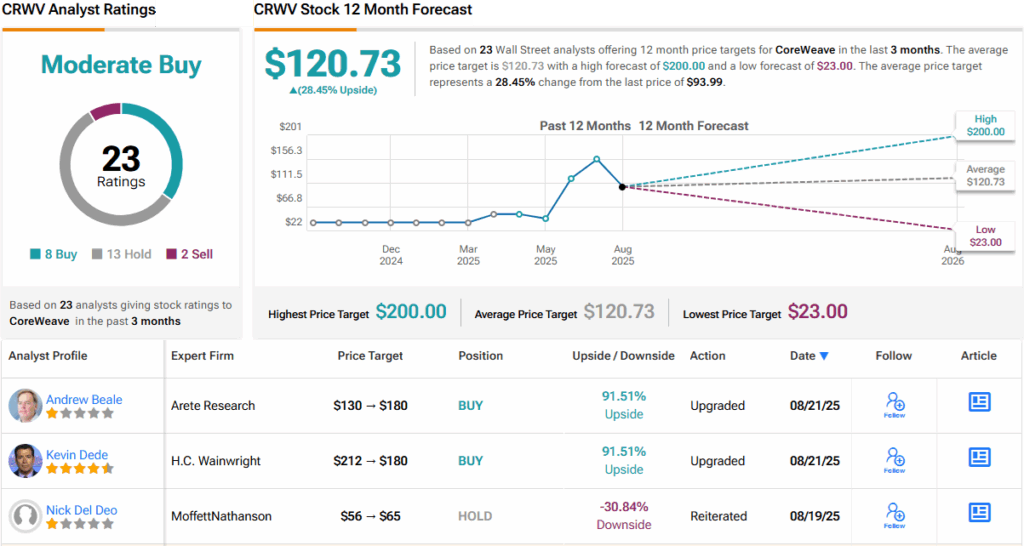

Overall, Wall Street’s stance on CRWV leans positive, though not without caution. The stock carries a Moderate Buy consensus based on 8 Buys, 13 Holds, and 2 Sells. Its 12-month average price target of $120.73 implies an upside of ~28%. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.