Semiconductor and technology company Broadcom (NASDAQ:AVGO) has seen its stock gain ~122% over the past year, triggered by the AI boom. In comparison, AI powerhouse Nvidia (NASDAQ:NVDA) has seen its stock price gain 220%. This raises the question: can Broadcom emulate Nvidia’s success and potentially join the $1 trillion market cap club? The answer appears to be yes. Given its attractive AI product offerings, solid business fundamentals, and relatively low valuation, I will buy AVGO stock at its current price.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Broadcom Will Gain from Innovations Across Its AI Portfolio

The AI revolution has swept the globe, and I’m confident in its sustained growth trajectory. This burgeoning industry, still in its early stages, is predicted to experience significant expansion across various sectors and applications. According to Next Move Strategy Consulting, the industry is anticipated to grow into a $1.85 trillion behemoth by 2030 compared to around $208 billion in 2023.

While Nvidia undeniably dominates the AI landscape, other players like AVGO are positioned to capitalize on the AI revolution by helping build gigantic AI infrastructure. This is especially true as major companies like Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), and Meta Platforms (NASDAQ:META) seek to diversify their reliance away from NVDA and explore alternative options.

This is where AVGO steps into the spotlight. Broadcom offers a wide range of semiconductor, enterprise software, and security products and solutions. It caters to a diverse clientele across data centers, cloud computing, networking, storage, software, broadband and wireless, among other areas.

Broadcom offers XPUs, which are customized AI accelerators that indirectly compete with NVDA’s GPUs. XPUs optimize AI architecture, enabling larger volumes of internal workloads at lower power and costs.

To tap the growing AI market, Broadcom continues to innovate and is set to unveil several offerings in the coming months. At its recently hosted “Enabling AI Infrastructure” event, AVGO threw more light on the future of Broadcom and AI. Broadcom’s PCIe technology and the switches it makes are expected to significantly accelerate the building of AI infrastructure across industries by efficiently connecting accelerators, CPUs, storage, and other components.

Currently, AI contributes a relatively modest percentage of Broadcom’s total revenues, around 20%. However, that number could massively increase soon. AVGO’s mega $69 billion acquisition of VMWare, completed in November 2023, is expected to add synergies and value to Broadcom’s existing portfolio of AI products and capabilities.

Recent launches such as Bailly and WatchTower Platform further underscore Broadcom’s commitment to innovation. Bailly, touted as the world’s first co-packaged optics Ethernet switch, operates at an impressive 51.2 terabits per second, promising substantial efficiency and performance enhancements for customers with scalable AI systems.

Moreover, the firm has forged strategic partnerships with top-tier tech clients that are poised to bolster its revenues for years to come. For instance, according to estimates from JPMorgan (NYSE:JPM), Broadcom is anticipated to generate revenues of $9 billion in FY2024 from just two clients: Alphabet’s Google and Meta Platforms, derived from the sales of AI-based integrated circuit chips.

Broadcom’s Business Fundamentals Remain Impressive

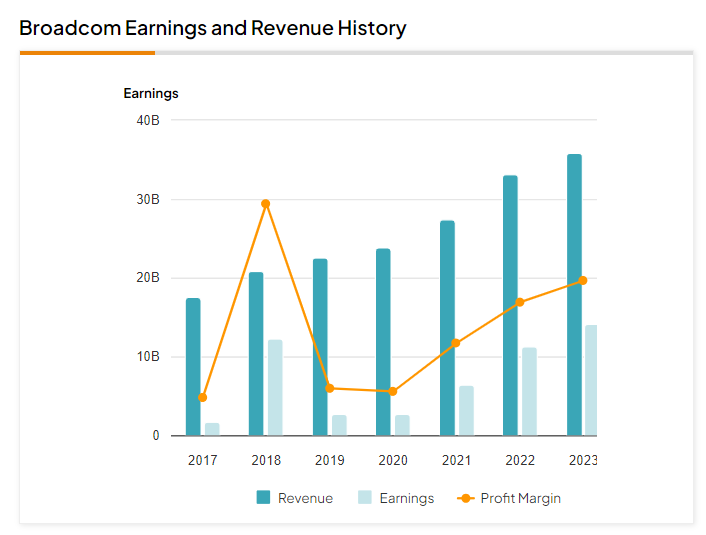

Looking at the last six years, AVGO’s revenues have more than doubled, soaring from $17.6 billion in FY2017 to $35.8 billion in FY2023 (see the image below). Even more noteworthy is the fact that its earnings have surged over 8x, climbing from $1.69 billion to $14.1 billion during the same period, primarily due to robust growth in profit margins. This consistent growth trajectory underscores Broadcom’s solid business fundamentals, instilling a strong sense of confidence.

I believe this is just the beginning of AVGO’s AI growth era. In the years to come, Broadcom will most likely report strong growth in revenues, earnings, and margins. Importantly, the company expects its FY2024 revenues to grow 40% year-over-year to $50 billion (including the impact of the VMWare acquisition).

What’s particularly impressive about AVGO is its resilient free cash flow, which has exhibited consistent growth in recent years. Despite the $69 billion VMWare acquisition, free cash flow margins have remained strong. In 2023, the company achieved a free cash flow yield of 3% of the current market cap, which is impressive.

Given these achievements, shareholders have been rewarded with consistent dividends and buybacks over the past few years. Moreover, having surpassed the $1,000 milestone in December 2023, Broadcom may consider a stock split, potentially making it more accessible for smaller retail investors to purchase the stock.

AVGO Stock Is Relatively Cheap Compared to Peers

In terms of its valuation, AVGO is trading at an attractive forward P/E ratio of 27.4x compared to higher multiples for its main peers. For instance, AI prodigy Nvidia is trading at a forward P/E of 33x, while U.S.-based semiconductor company Advanced Micro Devices (NASDAQ:AMD) is trading at a forward P/E of 42.5x.

Is AVGO Stock a Buy, According to Analysts?

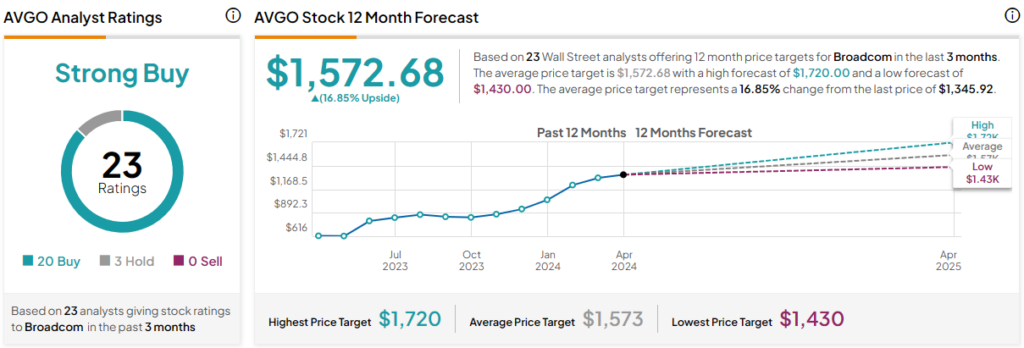

The sentiment among Wall Street analysts is decidedly positive regarding Broadcom stock. It boasts a Strong Buy consensus rating, with 20 Buy recommendations and three Holds. The average AVGO stock price target of $1572.68 implies 16.85% upside potential from current levels.

Conclusion: Consider AVGO Stock for Its Long-Term AI Potential

The projection of AI’s total addressable market (TAM) reaching a $2 trillion milestone by 2030 is immense. AI leaders like NVDA have already demonstrated impressive performance, and others like Broadcom are poised to benefit in due time.

Broadcom is displaying consistent signs of robust revenue and margin growth, bolstered by its VMware acquisition, ongoing innovations, and solid business fundamentals. With an enhanced AI offering and a diversified portfolio, I am inclined to purchase AVGO stock at its current price.