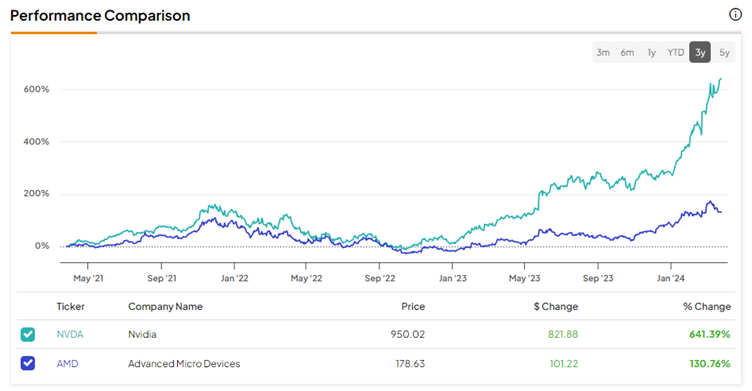

In the burgeoning artificial intelligence (AI) revolution, Advanced Micro Devices (NASDAQ:AMD) is second only to AI powerhouse Nvidia (NASDAQ:NVDA). AI’s jet-fast adoption has made NVDA one of the most rewarding multi-bagger stocks of all time. Could AMD be the next AI titan? The answer is yes. As the second-largest player in the AI chip market, AMD is poised to capitalize on the multi-year growth trends in the AI sector. Therefore, I will purchase AMD stock at current levels.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AMD Stands to Gain Directly from AI’s Adoption Across Various Applications

The AI revolution has taken the world by storm, and I firmly believe that its growth trajectory will endure. The AI industry, still in its infancy, is projected to witness remarkable expansion across diverse industries and applications. According to Next Move Strategy Consulting, the industry is anticipated to grow into a $1.85 trillion behemoth by 2030, compared to around $208 billion in 2023.

While NVDA undeniably holds the crown as the leading force in the AI industry, with an ~80% market share, AMD is also poised to reap the benefits of the AI revolution. It enjoys the “second-mover advantage” in this dynamic arena.

Despite starting later than NVDA, AMD and its AI counterparts are primed to capture a slice of the extraordinary growth opportunities. NVDA alone cannot meet the soaring demand for AI chips, presenting AMD with an opportunity to secure a significant portion of the market share, thereby driving its revenues and earnings.

What works in favor of AMD is the affordability of its AI chips compared to NVDA’s expensive GPUs. As the demand for cost-effective alternatives rises, global clients are turning to AMD. It’s no wonder then that major companies like Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META) are already integrating AMD’s AI chips into their systems.

Crucially, a major trend on the horizon is the integration of AI-based hardware into PCs and laptops, promising faster results, enhanced efficiency, and improved security. AMD aims to capitalize on the AI-based PC market that still remains in its nascent stage and offers substantial growth potential. Additionally, AMD’s Neural Processing Units (NPUs) could present a more feasible and cost-effective option compared to NVDA’s GPUs.

In addition, AI technology will capture the next wave of revolution in the mobile phone segment in the coming years. AI-compatible mobile phones will be the next buzzword, unleashing yet another stream of revenues for AMD’s leading AI chips.

Notably, AMD’s latest MI300 processor (launched in December 2023) has garnered significant attention in the AI landscape, directly competing with NVDA’s processors. In a recent earnings call, the company raised its sales guidance for the MI300 to $3.5 billion for the current year, surpassing its own prior guidance of $2 billion. Given this optimistic outlook, it’s likely that sales could surpass these levels, with the company potentially guiding for even higher numbers.

Additionally, new releases of hardware-related AI products will contribute incrementally to AMD’s revenues and earnings in the years to come. However, AMD faces challenges with export restrictions for AI chip sales to China. While NVDA has managed to offset lost revenues in China through growth in other regions, it remains to be seen if AMD can achieve similar success.

AMD’s Valuation Is Not Cheap but Still Appears Reasonable

To my surprise, AMD is trading at a higher forward P/E multiple (49x) compared to the AI prodigy Nvidia, which is trading at a forward P/E of 36.4x. What could be the reason for AMD’s higher valuation? The answer is clear: AMD will likely follow in NVDA’s footsteps in the next few years, as its AI growth story is just beginning.

Now, let’s consider whether it’s worth buying at all at current levels. Currently, AMD is trading at a one-year forward P/E multiple of 49x. Wall Street analysts expect AMD’s EPS to be approximately $7.06 in FY2026. If AMD keeps the same forward P/E multiple by then, its share price will be about $346, almost double the current price. Therefore, it makes sense to consider buying AMD stock at current levels, given the strong growth fundamentals in the AI space.

Is Advanced Micro Devices Stock a Buy, Sell, or Hold?

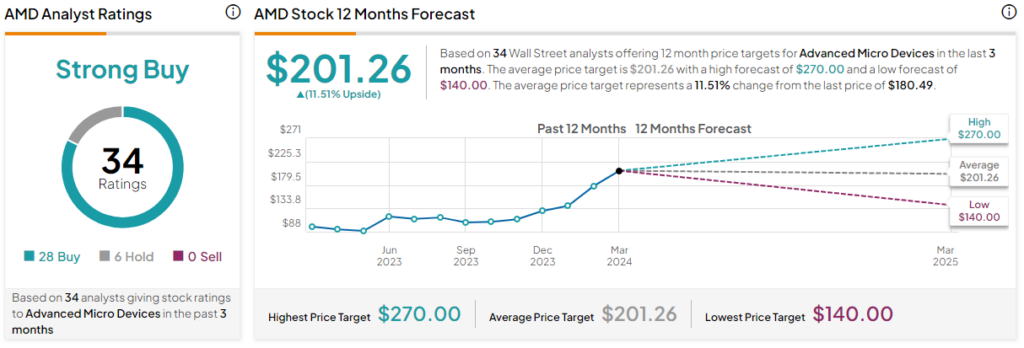

The sentiment among Wall Street analysts is decidedly positive regarding Advanced Micro Devices stock. The stock boasts a Strong Buy consensus rating, with 28 Buy recommendations and six Holds. Advanced Micro Devices’s average price target of $201.26 implies 11.5% upside potential from current levels.

Conclusion: Consider AMD for the Long-Term AI Potential

The projection of AI’s total addressable market (TAM) to reach around a $2 trillion milestone by 2030 is indeed gigantic. If AMD manages to capture a 10% share, it would result in a significant boost to its revenues and earnings over the long term.

What NVDA stock has seen in the past two years, AMD could see in the coming two years, as AMD’s AI growth story has only just begun. The stock is poised to benefit from the impending AI growth narrative. Therefore, I will buy the AMD stock at current levels.