Shares of Campbell Soup Company (NYSE:CPB) dipped about 9% on Wednesday after the processed food company reported mixed results for the third quarter of Fiscal 2023. The quarterly performance was affected by lower volumes and higher input costs. Another factor that dismayed investors was the profit guidance for FY23, which fell below their expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Following the results, Goldman Sachs analyst Jason English reiterated a Sell rating on the stock. He believes that the poor performance of the soup business is expected to persist in Fiscal Year 2023. Thus, the analyst expects CFB to “fundamentally lag peers who are still in the middle innings of a margin recovery cycle.”

CPB Q3 Performance Details

Adjusted earnings decreased 3% year-over-year to $0.68 per share in the fiscal third quarter but beat analysts’ consensus estimate of $0.65 per share. However, sales increased by 5% year-over-year to $2.2 billion and matched the analysts’ expectations.

The topline growth was driven by a 12% jump in average selling price, partly offset by a 7% fall in volume as consumers shifted to more affordable options.

Additionally, CPB said it achieved $880 million in total savings under its multi-year cost savings program in the reported quarter. Importantly, the company expects to achieve savings of $1 billion by the end of Fiscal 2025.

CPB Reiterated 2023 Outlook

The company reaffirmed its Fiscal 2023 sales outlook of 8.5% to 10% year-over-year growth. Furthermore, despite the rise in average selling price, CPB maintained its prior adjusted EPS guidance of $2.95 to $3 per share. This guidance remained below consensus estimates of $3.02 per share, which was disappointing for investors.

Is Campbell’s Soup a Buy or Sell?

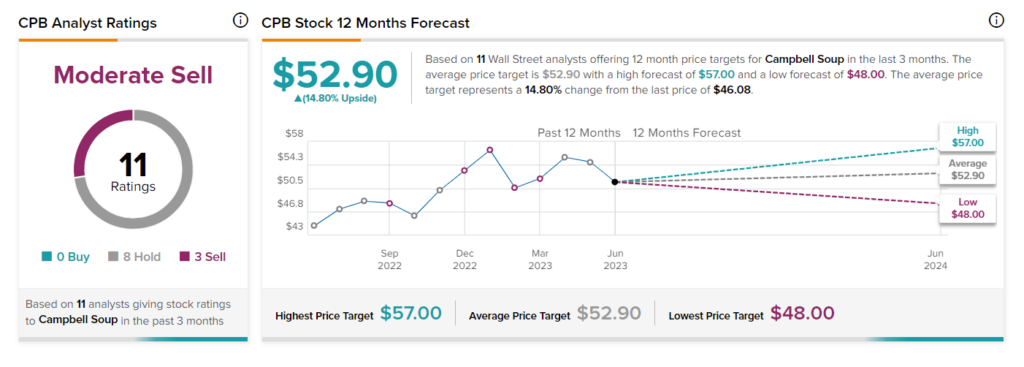

Turning to Wall Street, Campbell Soup has a Moderate Sell consensus rating. That’s based on eight Holds and three Sells assigned in the past three months. The average Campbell Soup price target of $52.90 implies 14.8% upside potential.