Cal-Maine Foods (NASDAQ:CALM) gained in pre-market trading after announcing robust Fiscal Q3 results. The largest producer and distributor of fresh shell eggs in the U.S. generated net sales of $703.1 million in Q3, a decline of 29.5% year-over-year but above consensus estimates of $692 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The decline in sales was a result of a fall in egg prices, with the net average selling price per dozen being $2.152 for conventional eggs in Q3, down by 41.5% year-over-year.

The company’s Q3 earnings more than halved year-over-year to $3 per diluted share, surpassing analysts’ estimates of $2.45 per share.

In addition, Cal-Maine declared a cash dividend of around $1.00 per share to holders of its common stock payable on May 16 to holders of record on May 1, 2024.

Bird Flu Setback

In a disappointing turn of events, the company announced that at one of its egg production facilities in Parmer County, Texas, a flock tested positive for highly pathogenic bird flu or avian influenza (HPAI). This discovery has led to the culling of about 1.6 million laying hens and 337,000 pullets or eggs, approximately 3.6% of the company’s flock as of March 2, 2024.

As a result, CALM has temporarily halted production at its facility according to U.S. Department of Agriculture (USDA) protocols.

Is CALM Stock a Buy?

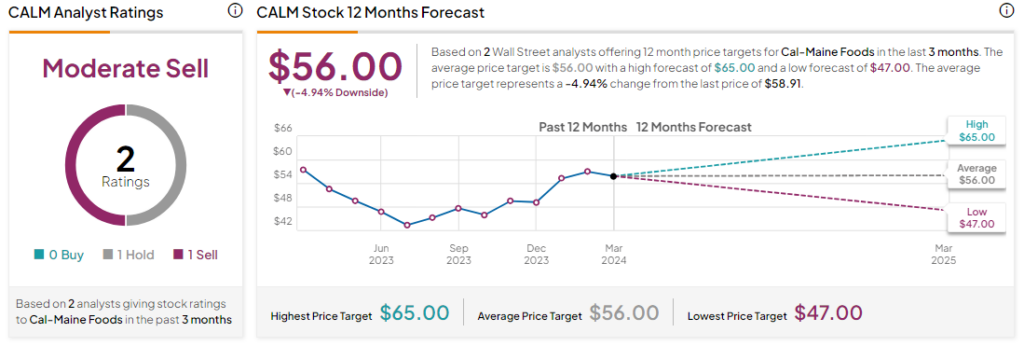

Only two analysts have covered CALM over the past three months, resulting in a consensus rating of Moderate Sell based on one Hold and one Sell each. Over the past year, CALM stock has inched up by 2.5% and the average CALM price target of $56 implies a downside potential of 4.9% at current levels.