The Infrastructure Investment and Jobs Act established the Broadband Equity, Access, and Deployment (BEAD) Program to expand high-speed, affordable internet access nationwide across all 50 states. This $42 billion program has been hailed as a “once in a lifetime” opportunity for the broadband service industry, one from which broadband managed services company Calix (NYSE:CALX) could be well-positioned for. Though potential rewards beckon on the horizon, the company faces a number of hurdles to profitability and investors should be advised to buckle up for a rough ride.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

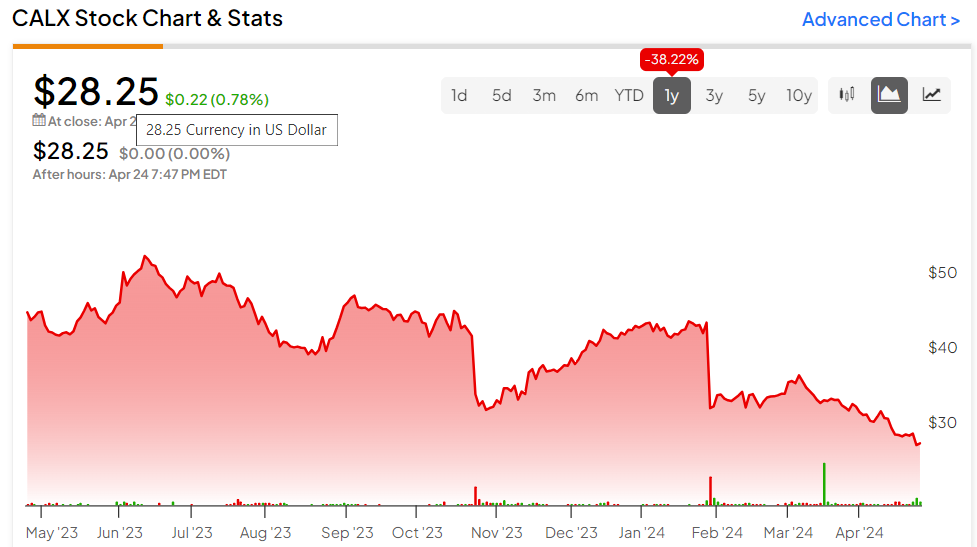

CALX has been down roughly 40% over the past year. Though management is projecting for the BEAD program’s rising tide to lift all industry’s boats later in the year, investors might be advised to waiting for the firm to show the benefits of the BEAD projects before initiating a position.

What is Calix?

Calix provides cloud and software platforms, systems, and services centered on broadband communications access systems and software for fiber and copper-based network architectures. This allows broadband service providers (BSPs) to better leverage their networks and connect with residential and business subscribers.

The company has made significant strides in enabling BSPs to simplify operations, engage more seamlessly with their subscribers, and foster business growth by using the Calix broadband platform, cloud, and managed services.

Calix has also simplified access to public funding programs such as BEAD. The company recently announced that 74% of all federally funded U.S. broadband providers successfully utilize the Calix Broadband Platform for compliance and reporting purposes. The platform facilitates network intelligence and testing applications and reports that its customers have exceeded 2 billion tests to measure speed and latency.

Calix Recent Financial Results & Outlook

The company recently reported financial results for the first quarter, with earnings per share of $0.21, exceeding analyst estimates by $0.01. However, the company’s revenue of $226.31 million fell short of the anticipated $228.14 million and decreased close to 15% relative to the prior quarter. Management attributed this decline to customers deferring purchasing decisions until later in the year when BEAD projects come online.

The company ended the quarter with cash and investments of $239.5 million, a sequential increase of $19.1 million primarily due to positive non-GAAP free cash flow of $11.0 million.

Management has given guidance for second-quarter revenue in the range of $197 million to $203 million, short of consensus expectations for $232.76 million. The company’s CFO, Cory Sindelar, commented on the Q1 earnings call that management “believes the June quarter will set the bottom for revenue”, and that revenue growth will resume in the latter half of the year.

What is the Price Target for CALX Stock?

The stock has been trending downward, shedding over 35% in the past 90 days. It demonstrates negative price momentum, trading below the 20-day (30.81) and 50-day (33.15) moving averages.

However, analysts following the company have been mostly bullish on the stock. For example, Rosenblatt Securities analyst Michael Genovese recently reiterated a Buy recommendation on the stock, though he lowered his price target from $45 to $35. He noted the company’s near-term challenges, but remains constructive on its upside potential as the BEAD funding gets deployed.

Calix is rated a Strong Buy based on the recommendations and 12-month price targets six Wall Street analysts issued in the past three months. The average price target for CALX stock is $47.33, which represents an 67.54% upside from current levels.

Final Thoughts on Calix

BSPs sit at the precipice of unprecedented industry growth fueled by the BEAD Program. Given its unique role in the industry, this positions Calix favorably for significant growth. However, the company’s recent financial performance has underdelivered due to customers deferring purchases in anticipation of the BEAD projects.

While current hurdles may present a challenging picture, Calix’s potential gains might make it worth considering when it begins to reap the benefits of the BEAD initiatives. Investors interested in participating in the upside of this unique situation might benefit from keeping an eye on the company, while looking for a window of opportunity later in the year.