California Governor Gavin Newsom has filed a $787 million lawsuit against Fox News (FOXA), accusing the network of defamation for misrepresenting a phone call between him and President Trump. The legal complaint claims that Fox News knowingly edited footage and broadcast misleading information that suggested Newsom lied about not speaking with Trump on a specific date. The focus of the lawsuit is on a June 10 segment by host Jesse Watters, who claimed Newsom had lied about the timing of the call.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A graphic shown during the broadcast declared, “Gavin Lied About Trump’s Call,” while Watters pointed to call logs showing a conversation had taken place on June 6 or 7. According to the lawsuit, the phone call did happen, but earlier than Trump had later claimed. Newsom’s legal team argues that Trump misstated the date of the call during a White House briefing and that Fox News took advantage of this inconsistency to falsely paint the governor as dishonest. The suit also claims that Fox’s actions were politically motivated by pointing out that Newsom is a vocal progressive critic of the network’s conservative agenda.

Newsom alleges that Fox distorted the facts to stay in good standing with Trump and amplified the falsehood with selective editing, rather than correcting the record. Newsom is demanding a retraction and a formal on-air apology from Watters in exchange for dropping the suit. His lawyers argue that the network’s actions are essentially propaganda and undermine public trust. However, Fox News responded by stating, “Gov. Newsom’s transparent publicity stunt is frivolous and designed to chill free speech critical of him. We will defend this case vigorously and look forward to it being dismissed.”

Is FOXA Stock a Good Buy?

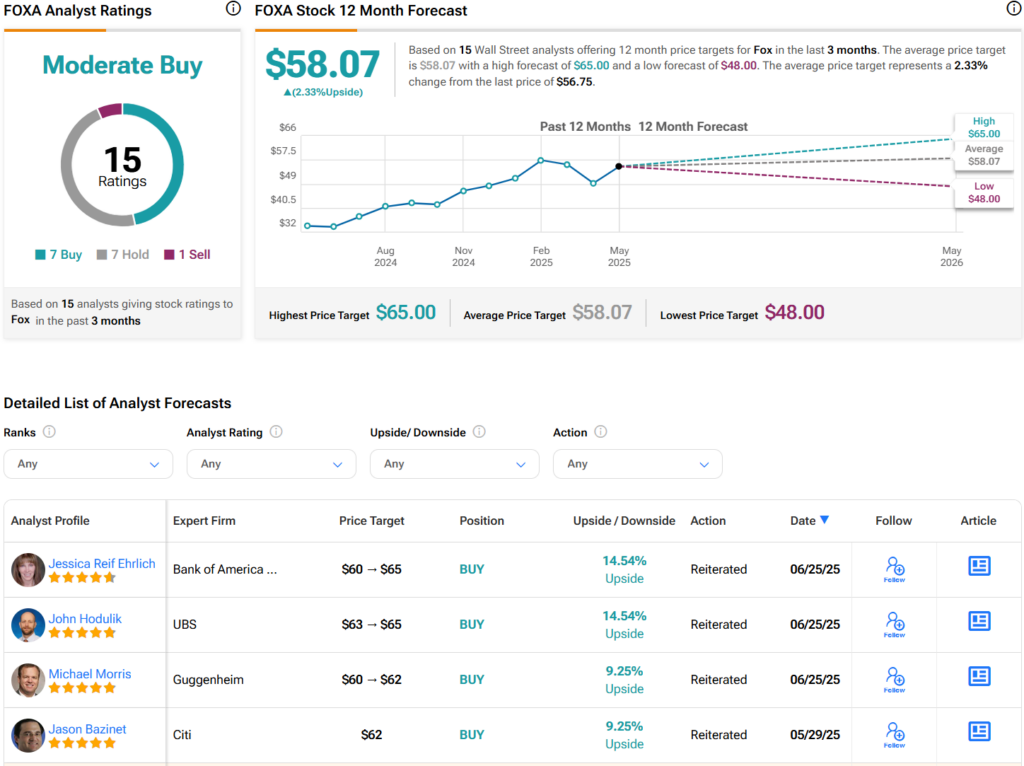

Turning to Wall Street, analysts have a Moderate Buy consensus rating on FOXA stock based on seven Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average FOXA price target of $58.07 per share implies 2.3% upside potential.