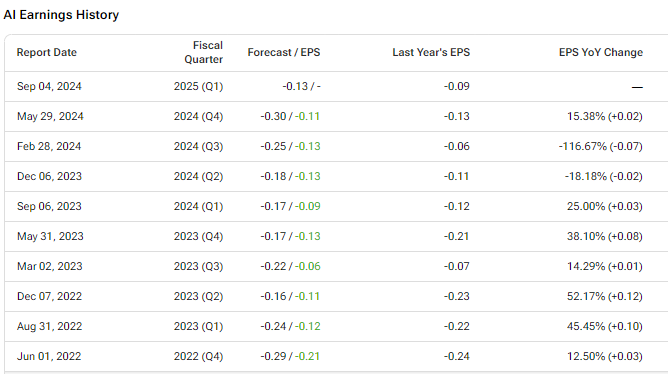

Enterprise AI software provider C3.ai (AI) will release its first-quarter Fiscal 2025 results after the market closes on Wednesday, September 4. Wall Street expects C3.ai to report sales of $86.94 million in Q1, up about 20% year-over-year. Meanwhile, analysts expect the company to post a loss of $0.13 per share, greater than the loss of $0.09 reported in the prior-year quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

C3.ai’s rising marketing expenses along with high customer acquisition costs may have affected its bottom line. However, strong demand for generative AI solutions during the quarter is expected to have bolstered its top-line performance.

It’s worth highlighting that C3.ai has surpassed the consensus EPS estimates in all of the last nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool shown below, analysts are optimistic about the company’s expanding customer base. Furthermore, they are impressed by C3.ai’s rising subscription revenues. Interestingly, in Q4FY24, it increased by 41% year-over-year, marking the fifth consecutive quarter of growth.

However, some analysts are bearish about the company’s near-term potential to become profitable. They noted that C3.ai projects a wider loss in FY25 than it reported in both Q4 and Fiscal 2023.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can gauge what options traders anticipate for AI stock right after its earnings report. The expected earnings move is calculated by evaluating the at-the-money straddle of options that are set to expire soon after the announcement.

At present, the tool indicates that options traders are predicting a 14.22% swing in either direction for the stock.

What Is the Price Target for C3.ai?

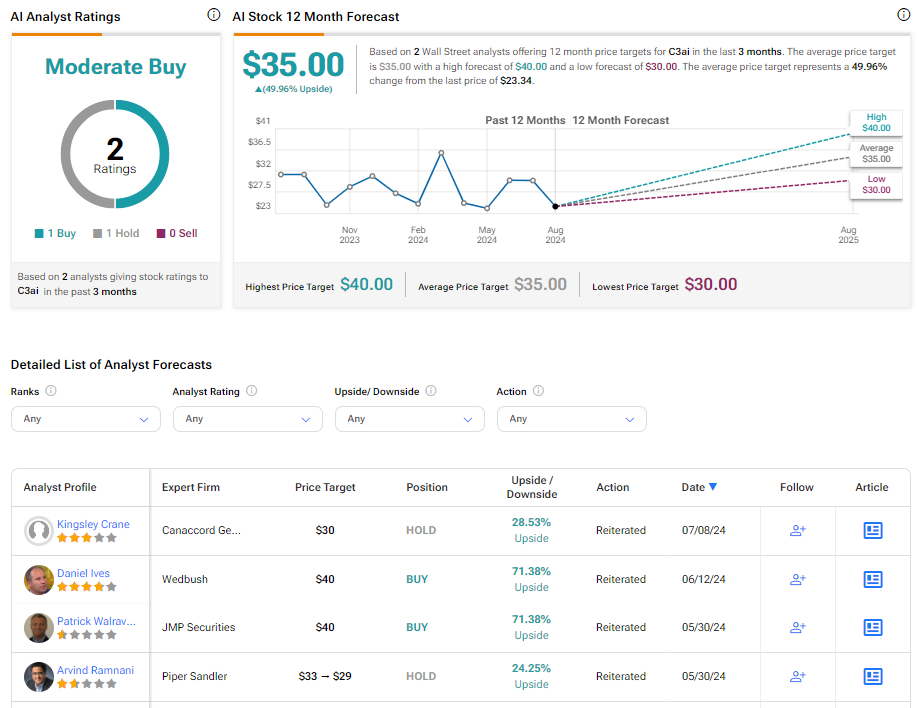

On TipRanks, C3.ai has a Moderate Buy consensus rating based on one Buy and one Hold rating. The analysts’ average price target on C3.ai stock of $35 implies 49.96% upside potential. Shares of the company have declined 31.5% over the past six months.