Shares of Beyond Meat (BYND) fell in after-hours trading after the vegan food company reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at -$0.47, which missed analysts’ consensus estimate of -$0.40 per share. In addition, sales decreased by 13.3% year-over-year, with revenue hitting $70.22 million. Still, this beat analysts’ expectations of $69 million.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Revenues mainly fell because the company sold 10.3% fewer products and earned 3.5% less revenue per pound. The drop in sales volume came from weaker overall demand, fewer stores in the U.S. carrying the products, and lower international foodservice sales of its burger products to quick-service restaurants. Indeed, we can see in the image below that pounds sold have been declining over the past several years.

Meanwhile, the decline in revenue per pound was due to offering higher trade discounts, selling a different mix of products, and lowering prices on some items, although this was slightly offset by foreign currency exchange rates.

Outlook

Looking forward, management now expects revenue for Q4 2025 to be in the range of $60 million to $65 million. For reference, analysts were expecting $70.3 million in revenue.

Is BYND Stock a Good Buy?

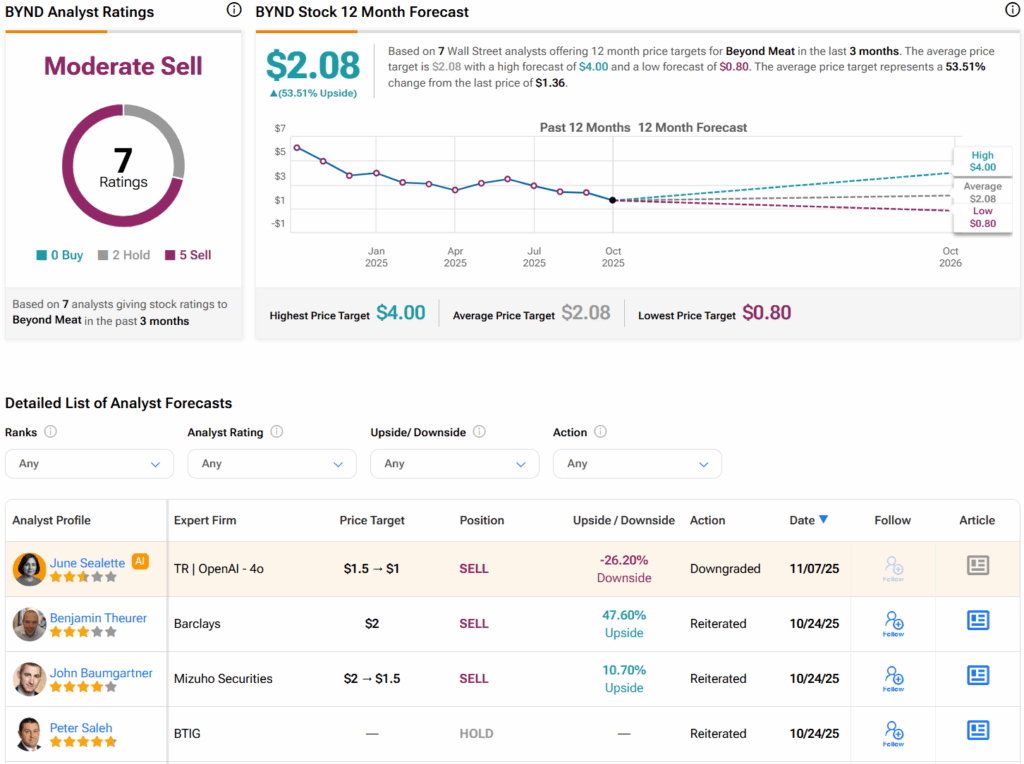

Turning to Wall Street, analysts have a Moderate Sell consensus rating on BYND stock based on two Holds and five Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average BYND price target of $2.08 per share implies 53.5% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.